Weekly Wrap #15: Winners, Losers and Tie-Dye

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

Please keep the great feedback coming. If you love the Weekly Wrap, share away.

2020: Tie-dye & hungover DIY haircuts

This week the Economist highlighted Google search data that confirms that the pandemic has thrown our world upside down. Who would have thought?!

Unsurprisingly, it confirms we’re no longer going out for wine, dine and concert time. Instead, we’re Zooming from standing desks in our lounge, wearing our home-made tie-dye shirts, pumping neoprene-coated dumbbells as bread bakes in the oven.

If you hate change, don’t despair… there is one constant in our pre and mid-pandemic lives: hangovers!

Source: Economist - Global change in mobility and Google searches, compared with normal levels.

What to do in a time of certain uncertainty

In business, timing is everything. By now the list of industries benefiting exponentially from being on the right side of the pandemic is clear - eCommerce, logistics, collaboration and communication tools, cloud infrastructure and home improvement are examples. Others were not so fortunate - travel, events, weddings and physical retail to name a few.

But there is also a host of industries in between—financial services, recruitment and education are examples—for which the impact of the pandemic has been hard to predict. This is clearly illustrated in the mix of ASX results announced this week and the resulting shift in share prices.

Here’s a snapshot to give you a quick flavour (all AUD):

Australia’s largest bank, the Commonwealth Bank announced it will pay a final dividend of 98 cents. That’s 6 cents more than expected, but also the first time it has paid a dividend below $1 since 2006. Cash profits were down 11 per cent to $7.3B for FY20, but operating income was up 0.8%.

Recruitment platform, Seek abandoned dividends altogether. It’s ANZ revenue dropped 12%, while China (Zhaopin) rose 12%. It continues to invest for growth.

Telstra reported a 16% drop in profits, with total income falling 5.9% to $26B. Fixed line, data, roaming and mobile revenues all fell. It still released $1.9B in dividends to shareholders this year.

Industrial property giant Goodman Group reported $1.06B profit (up 12.5%) thanks to increased demand for warehouses supporting eCommerce and data centres. Goodman’s market cap is now $33B. For context, that’s more than three times Westfield’s parent company (Scentre Group) value.

The newest ASX tech and eCommerce “darlings” including Afterpay, Openpay, NextDC, Kogan.com, have or are expected to post record-breaking growth.

You’re probably wondering, “wait, why are you rabbiting on about corporate results? This newsletter is meant to provide insight into the tech and startup world, not bank earnings.”

Fear not, there’s a method to our madness.

These results reinforce just how much uncertainty and disruption surrounds our world at the moment. The way we work, the way we live, the way we buy has all been significantly altered. We don’t know how long this will last. And we don’t know for sure what a post-pandemic world will entail.

With the current rate of change and inability to predict the future, there is no room for the status quo. The future success of every business will be dependent on its ability create and execute an adaptive, purpose-driven strategy for the long-term i.e. its ability to embrace the uncertainty, move quickly and take smart risks, just like any great startup.

A timely reminder, Blockbuster popped onto twitter this week to see how 2020 is going:

Corporate innovation motivation

Telstra provides a good example of an incumbent whose need to adapt isn’t new, but has been compounded by the pandemic.

In recent years, Telstra has attributed billions of lost revenue to the rollout of NBN (it was forced to give up control of its broadband network to the government-owned wholesale operator). Its traditional revenue streams are dropping off as people abandon landlines and as competitors offer cheaper comparable mobile and internet solutions (its fixed line internet margins are a mere 1.8%). And now, thanks to the pandemic, it estimates a further $400M earnings blow in FY21.

In its attempts to transform, Telstra has been busy cutting costs, removing some (but not all) of the Telstra “lifers” who have stuck around for 20+ years, while pursuing the traditional avenues of “corporate innovation” - innovation labs (Telstra Labs), entrepreneurs-in-residence, corporate accelerators (muru-D), and its own VC fund (Telstra Ventures).

But the reality for Telstra (and we’d argue, almost every corporate) is that these are all hobbies, not a silver bullet. Innovative thinking does not magically flow into the core company culture as a result. Nor are these activities generally very productive in terms of providing significant new revenue streams.

Sometimes I want to bottle those few days where we made that huge pivot [to remote working at the start of the pandemic] and then spread it out from time to time... The way we made decisions in those moments has to be the way we do it going forward from today. It's hard to maintain…

Patrick Wright, NAB CTO

Future-proofing a business like Telstra requires two things:

Having a clear strategy about how to use technology as a competitive advantage. This is about more than throwing around technology buzzwords like AI, IoT and TikTok or creating a ‘digital’ division. It’s about understanding how technology is upending business models, how it is influencing long-term trends like customer experience and eCommerce, and how to use technology to create better processes, products and services.

Creating a culture of innovation. This means making space for experiments, smart failure, challenging of assumptions, quick decision making and action. Plus, creating a purpose-driven environment that attracts the best talent, guides their work and serves to unlock their full potential.

To know your enemy, you must become your enemy

Sun Zhu

Both of these have to be led from the top. They may sound like overwhelming tasks, but what’s the alternate?

Meaningful technology discussions and big thinking needs to happen at the boardroom table/Zoom call. However technology literacy on most boards is woeful considering its importance today. Less than 11% of the S&P 500 have a technology committee on their board.

Most directors have a great understanding of how to monetize and derisk traditional assets. But this doesn’t translate to the new class of problems, opportunities and risks created in today’s uncertain and disruptive landscape.

Recognising the skills, gender and age diversity gap at its Board level, this week Telstra took a step in the right direction by appointing 32-year old tech entrepreneur Bridget Louden to its Board. Louden is the Co-founder and CEO of a consulting marketplace Expert360, which is challenging traditional employment models. So she brings with her a younger, digital/tech, global, entrepreneurial and female perspective that Telstra, along with many other boards, so clearly lack.

Appointing Louden is one step. However it will be hard for her to achieve much as a lone wolf (perhaps as her predecessor, Trae Vassallo experienced). The Board must prioritise radical cultural transformation and innovation discussions, educate themselves and provide space/mentor Louden to be in a position to influence change by the Board and Telstra as a whole.

Rapid fire: News that caught out eye this week 🧐

A battle is brewing between Fortnite’s developer (Epic Games) and Google and Apple over their Play/App Store fees. Epic released an app update that let users bypass App Store and Play Store in-app payment mechanisms (which attract a 30% commission). In response, Google and Apple removed Fortnite from their stores. Epic is suing over anticompetitive practices, mocking Google's "Don't Be Evil" motto in the suit. Touché.

Is the founder always the best person to grow the business? These guys may have an opinion:

Tim Cook has returned more money to shareholders (US$475.5B) than what Apple was worth in 2011 (when he took the reins - $348B).

Microsoft’s market cap has grown by a trillion dollars in 6 years under Satya Nadella.

Payment platform, Stripe is levelling up. It poached GM’s CFO, achieved its 2020 customer targets 6 months early, is processing hundreds of billions of dollars per year and has ~2,800 employees - that’s an estimated US$1M of net revenue per employee (at a 1% net revenue take rate).

A Californian court has issued a preliminary injunction requiring Uber and Lyft to reclassify drivers as employees (not contractors) - a “prolonged and brazen refusal to comply with California law”. This might mean they have to shut shop in Cali.

Airtree led a AU$3.1M investment in digital insurance platform, Open - “Insurance built for the digital age”. There’s a lot of room for disruption in insurance and investors are hot in this space. The successful pop of the Lemonade “Forget Everything You Know About Insurance” IPO recently has only helped fuel interest.

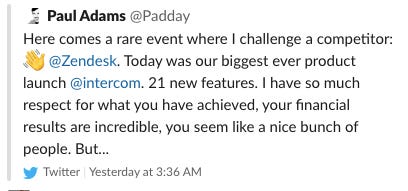

Live chat/conversation platform, Intercom is ramping up for IPO, hiring a new CFO. Meanwhile, its SVP Product made an unfortunate PR blunder on twitter, arrogantly telling the world why Intercom is better than Zendesk (“you’re old and slow; we’re new, fast and can build more features faster than you”).

The tweet thread has since been deleted. Let’s just say it wasn’t well received by the usually cordial product community.

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

p.s. We love feedback - if you have any or want to continue the conversation, please reach out.

p.p.s. Watch Gavin live on AusBiz at 2pm on Mondays, when he opens the Startup Hour of Power.