Weekly Wrap #19: BVP Bares All, Results are Slack and Banks... Innovate?

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

Please keep the great feedback coming. If you love the Weekly Wrap, share away.

The Innovator’s Dilemma

On Thursday with much fanfare NAB launched a “completely different” 0% interest credit card, “StraightUp”. Within hours CommBank announced it was launching a carbon copy product, “Neo”.

The products are an attempt to compete with buy now pay later (BNPL) platforms like Afterpay, Zip, Openpay and perhaps soon, PayPal. Together, these BNPL companies have more than 5.8 million customers in Australia and fund about 10% of all online sales. The majority of BNPL customers are under 35.

It’s great to see the big banks trying to do something innovative. But here’s the thing… they haven’t truly followed Startup Mindset Principle #1: Obsess over your customers. This requires you to understand your customers’ needs, pain points and behavioural drivers, and build product that delivers meaningful value to them.

Let’s look at the reasons why people under 35 (Millennials and Gen Z) became rapid adopters of BNPL:

Not a credit card: They grew up through the GFC, where the world around them subliminally drilled into their heads that going into debt was bad. Plus, compared to past generations the cost of education and housing has skyrocketed, salaries haven’t caught up and job security is low. Now add to this Covid. People under-25 are most likely to have casual jobs in hospitality, retail, childcare and other industries affected by pandemic lockdowns and restrictions.

These consumers are much more aware of the risk of the debt trap than the generations prior and they don’t want to get into debt because of frivolous spending. They don’t have credit cards because they don’t want them.

BNPL is the middle ground between debit and credit. The payments are structured and there are controls in place to prevent consumers accruing excessive debt. Afterpay, for instance, emphasises responsible spending as a part of its brand and product design (also a great tactic to keep regulators off your back).No fees: Think of all the free services available to these generations. Instagram, TikTok, Spotify, YouTube, eCommerce free shipping are just a few examples. Convenience is no longer a justification to charge consumers a fee - you must provide meaningful value.

BNPL costs nothing, unless you default on payment = justifiable reason to charge a fee.Quick & convenient: The online world has established an expectation of instant, frictionless experiences for these digital native generations.

BNPL takes 2 minutes to setup online. An 18 year-old can probably sign up to a new Afterpay/Zip account faster than you can find your wallet in your handbag, open it, pull out the card and pay. Also, there’s no need for a physical card - it’s all on their phone.

Ok, so with that in mind, let’s compare that to the banks’ products: It’s a credit card. Fees of $10-22 are charged each month you use it/have a balance. You have to wait up to five days for NAB’s card to be mailed before you can access funds. CommBank’s card isn’t available yet so we don’t know what the sign up process will entail.

These products may be novel from each bank’s perspective. But less so from that of their target audience.

FinTech startups now offer easier, cheaper and faster solutions across most banking products. For instance in Australia we have everyday banking (Up, Volt, Xinja), home loans (Athena), other loans (Prospa, StudyLoans, Moula, Harmoney), money transfer (Transferwise, PayPal), share trading (Sharesies is coming soon, eToro) and business payment solutions (Stripe, Tyro, Airwallex).

The list of reasons why our digital native generations need the direct services of a big 4 bank is getting smaller by the second.

Before they were famous

They brought us the State of the Cloud. They brought us the notorious Cloud Index. They brought us the infamous VC anti-portfolio.

This week, one of the oldest, biggest names in VC, Bessemer Venture Partners went one step further and “open sourced” (a.k.a. made public) its original internal investment memos for iconic unicorns including Shopify, Twilio, Pinterest, MindBody and LinkedIn.

These days it’s common practice for VCs to release investment notes. But it’s not often that you get to read internal investment memos on some of the best VC deals in history.

Investment notes tell the world why the VC chose to invest in the startup. Of course, because they’re released in real-time, these pieces are written with rose-tinted glasses, with statements like: “the next big thing in X”, “an all-star founding team”, “impressive growth metrics”.

Investment memos are a more balanced summary of the investment written for the VC’s decision making purposes. They provide deep dark commentary on the company’s risks—churn, target market, competition, management capability, for instance—weighed up against the glorious opportunity e.g. growth metrics, competitive advantage, market size, upside potential.

For fundraising startups and wannabe investors, the Bessemer investment memos shine a light on how a world-class VC analyses its investments, considers potential up/downside and plots how to mitigate risks.

Below are a few data points we found interesting from Bessemer’s Shopify, MindBody and LinkedIn memos. Any investment figures and valuations are based on the memo. They likely changed slightly as negotiations finalised.

Shopify (founded in 2004)

Invested in 2010 leading a $5 million Series A at a $20 million pre-money valuation. Bessemer were given two of five board seats and had the right to force a sale after 6 years.

Traction: $5.5m ARR (+151% YoY). EV was equivalent to 3.6x ARR. 10,000 customers (+81% YoY). Churn was high because of Shopify’s SMB customer base - by month 12, only 50–60% of customers remained. But this didn’t concern Bessemer since the CAC was low (7-9 months), with a strong LTV.

Team: Shopify’s CEO Tobi Lütke was young and a first-time CEO, leading Bessemer to weigh up replacing him. Good thing they didn’t - Tobi has been at the helm ever since, building a $112+ billion SaaS behemoth. It seems Tobi developed a great relationship with the Bessemer team by being honest. He explains in a 2019 “How I Built This with Guy Raz” podcast episode:

I told them straight off the bat, saying, ‘I’m not going to pretend to know things I don’t know and I really hope you’re going to help me in this journey’… Ten months after the Series A, Jeremy and Trevor from Bessemer came to me and said, ‘You are still massively constrained by money, how about instead of you spending a bunch of months of fundraising, we’ll just quadruple the valuation of the company and put much more money [$15 million] into this because you can grow this way faster.

Scenario analysis: Proved to be a little conservative - “the upside case was off by more than two orders of magnitude!” At the time of its IPO in May 2015, Shopify’s revenue was $105 million with 162,000 customers. It listed at a valuation of $1.27 billion and surged as much as 69 percent above its IPO price in the first days of trading.

Mindbody (first SaaS product launch 2003)

Invested in 2010. $14 million round at a $42 million pre-money valuation.

Traction: Over 8,500 clients, $867k in MRR and $1m in monthly revenues. EV equivalent to 4x ARR. Good CAC of 13 months and 3.4x LTV.

Product: Mindbody’s product was considered “underwhelming and dated in its user experience”. But since competitors’ products were no better and they were “poorly capitalized and sub-scale”, Mindbody could use the funding to step up its product game.

Team: Although he was a first time founder, Navy veteran Rick Stollmeyer clearly impressed Bessemer thanks to a metrics-driven, calculated mindset:

They’ve taken a highly analytical approach to managing their business— monitoring the core metrics of their SaaS business on an ongoing basis. They’ve also proven capable of building a scalable sales and marketing funnel.

Market opportunity: This was Bessemer’s biggest area of concern. Mindbody had done well in the yoga/pilates market but was yet to be proven in other verticals. In contrast to most ANZ startups who think global from day one, the market sizing appears to be purely North American focussed.

The company is clearly winning in yoga and pilates, but with 30% penetration already, there is not as much room for growth. To reach $50m+ in annual revenues, MindBody needs to broaden its target customer verticals.

Mindbody went public in 2015, raising $101 million at a $448 million valuation. It had over 42,000 customers at the time. FY15 revenue totalled $101 million (+45% YoY) - so they clearly overcame Bessemer’s market penetration concerns.

As a relatively small cap listed company, Mindbody had a rocky ride with public investors and was acquired by Vista Equity Partners in early 2019 for $1.9 billion.

LinkedIn (founded 2002)

Invested in 2006 - for context that’s when MySpace was still a thing. LinkedIn is described in the memo as the “MySpace for business users”. $12.5 million Series C at $237.5 million pre-money valuation.

Traction: LinkedIn had just broken even with 8 million users and a ~$17 million run rate ($1.4 million/month). Despite being a Series C, Bessemer were the only investors in this round. This was likely due to valuation - at 14x ARR this was “a fully-priced deal” i.e expensive.

Team: Even though the team was full of Harvard/Stanford/PayPal’s best and brightest, team was seen to be a risk:

The senior management team is still thin. As we recruit a CEO and a couple of new VPs, the goal would be to have a positive influence on the culture and dynamics of the company, but these transitions go poorly almost as often as they go well.

Scenario analysis: Again, Bessemer’s scenarios proved to be conservative. Just 2 years later in 2008 LinkedIn raised at a $1 billion post-money valuation. The company went on to IPO in 2011 at a $4.5 billion valuation, popping a further 84% on first trade.

Microsoft acquired LinkedIn in 2016 for $26.2 billion. From an outsider’s perspective both LinkedIn and Microsoft have done a great job allowing the company to flourish post-acquisition.

Rapid fire: News that caught our eye this week 🧐

Australia and NZ:

Vend is turning 10. An NZ SaaS veteran, Vend was the first point of sale solution that was cloud-based and available on an iPad. It’s also close to our hearts - Vend was Bex’s first SaaS client from her lawyering days. It was also one of Square Peg’s first investments. Founder Vaughan Fergusson and Vend’s early team are taking time to reflect on Vend’s history, releasing a series of blogs covering each year of the company’s journey. Happy birthday Venders!

Recognising that seed and angel investment has “dropped off a cliff in the last three years”, AirTree announced a pilot program to help build the next generation of angel investors in ANZ. As a part of the program AirTree are also making a pledge that each time it leads an investment it will bring at least one investor from an underrepresented group on to the cap table. Nice.

Elevate NZ Venture Fund (the NZ Government’s new venture capital fund) is investing NZ$21.5 million into Blackbird’s NZ$60 million NZ fund led by Partner, Sam Wong. Blackbird’s NZ investments include AskNicely, Sunfed Meats, FreightFish and AO Air.

Work180 raised almost AU$1.7 million to help drive its expansion in the UK and US and grow its marketing team. Work180 is a jobs marketplace that pre-screens employers to ensure they support women in the workplace. Across many countries, Covid has left more women unemployed than men. Work180’s Founder Gemma Lloyd says the pandemic has fuelled demand for its services as companies look to bolster gender diversity and inclusion.

Applications for Atto’s pre-accelerator program for aspiring women founders are open. A great option for you are a non-technical founder who wants to build/test out your MVP on the side. Atto teaches everything needed to go from idea to prototype - no code fundamentals included. Atto recently received funding from LaunchVic to expand its 2020 and 2021 cohorts.

Australian rocket company Gilmour Space Technologies has signed its first local customer for the maiden voyage of its Eris rocket in 2022. The launch will mark an important milestone for Australia and our space industry - it’ll be the first time an Australian payload has been launched on Australian soil using an Australian rocket.

Fast, whose founder and CEO is Australian Domm Holland, launched Fast Checkout last week after a huge marketing build up. Fast allows online buyers to complete purchases with one click (in partnership with Aussie-founded BigCommerce). In April Fast raised AU$30 million in a Series A round led by Stripe. Great ad:

Around the world (all in USD):

Although Slack beat analyst expectations, its shares fell 18% after releasing its Q2 results. Public investors’ expectations have been blown out of the water by companies like Zoom and Shopify who are well and truly riding the Covid digital transformation wave. They expect bigger, better results. Slack’s results are a reminder that for most SaaS companies, Covid is a rollercoaster. Budgets are tight and Slack isn’t necessarily a ‘must-have’, particularly for those already in the Microsoft camp.

Taboola and Outbrain called off their $850 million merger that would have valued the combined company at more than $2 billion. The startups that each provide publishers with an ad-based content recommendation platform. This deal has been in the making for a loooong time - rumours started in 2015 and the deal was finalised in October 2019. Supposedly financiers providing the cash component stalled. But it sounds like they might have dodged a bullet, with insiders describing there being a “challenging cultural fit” between the two companies and the potential ongoing regulatory concerns.

India is a hotbed of investment right now. Indian food delivery startup Zomato raised $100 million from Tiger Global (which also has Australian investments in Tyro, Practice Ignition and SafetyCulture) as it prepares for IPO. India’s largest learning platform Unacademy raised $150 million led by SoftBank at a huge $1.45 billion valuation. Music and podcast streaming platform Gaana raised $50 million from Tencent.

According to informed rumours, Apple will release a unified subscription bundle soon. It would provide customers a bundle discount - e.g. Apple Music, Apple TV+, Apple Arcade, Apple News+, and an iCloud subscription.

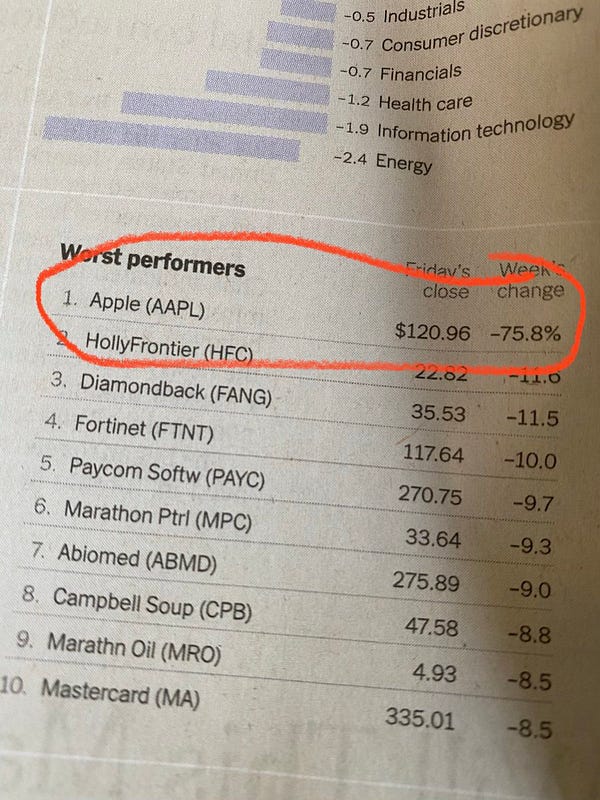

Meanwhile, the NY Times this week listed Apple (the most valuable company in the world) as the worst performing stock, failing to recognise a ‘drop’ in share price was the result of a share split. Ooops.

The Fresh Prince of Bel Air debuted 30 years ago. Will Smith and Tyra Banks reminisced Covid-style, making the most of tech:

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

p.s. We love feedback - if you have any or want to continue the conversation, please reach out.

p.p.s. Watch Gavin live on AusBiz at 2pm on Mondays, when he opens the Startup Hour of Power.