Weekly Wrap #23: We Grammin', Innovation Celebration and 99Exits

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

Please keep the great feedback coming. If you love the Weekly Wrap, share away.

Do it for the ‘gram

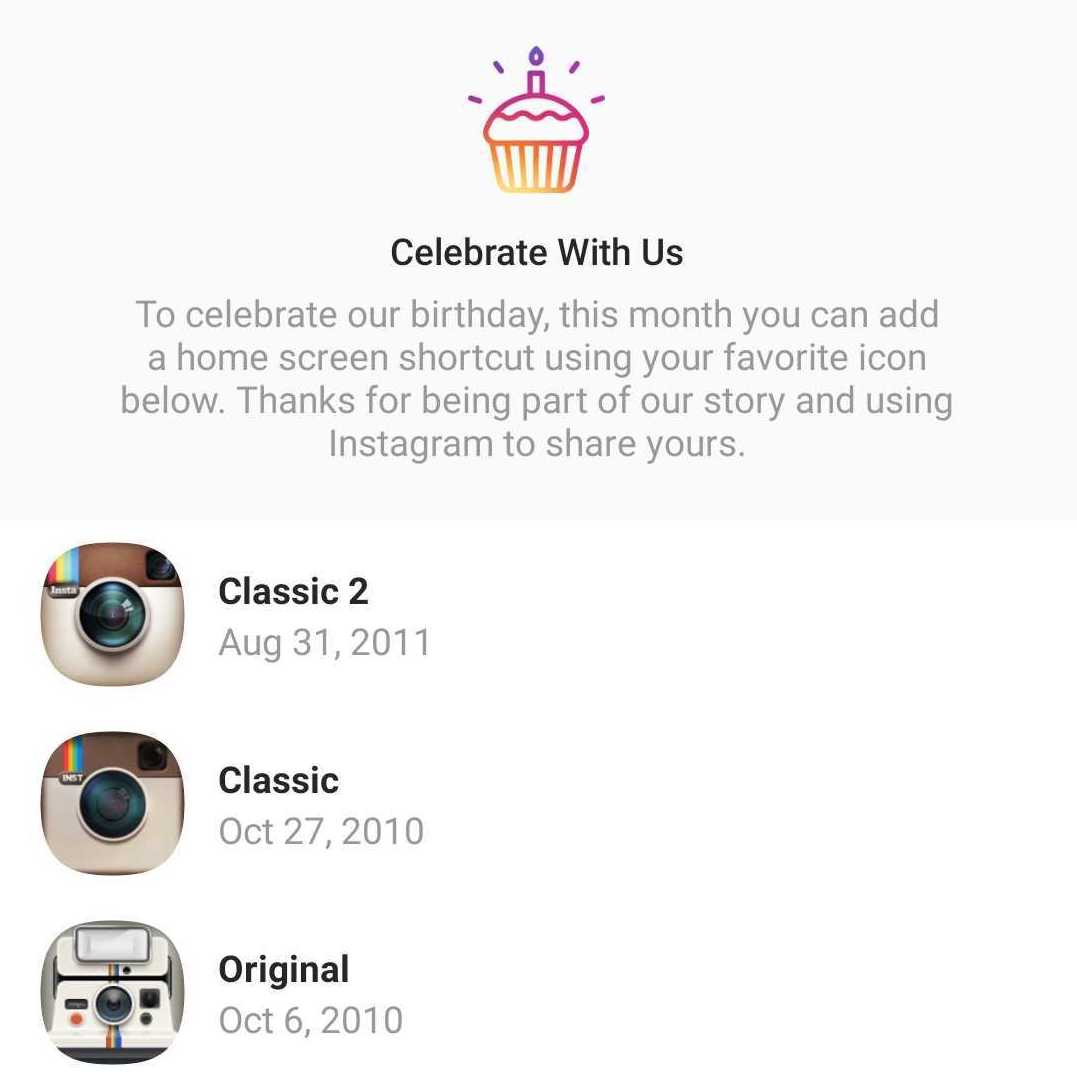

Instagram turned 10 on Tuesday! This week we stroll down memory lane, taking a look at Instagram’s milestones, stories and scandals.

Founded by two Stanford grads, Kevin Systrom and Mike Krieger, Instagram is a great example of one of the most overused startup buzzwords in action… a pivot. It started life as a web app called Burbn, a check-in app similar to Foursquare. But the founders soon realised that location based check-in was an overcrowded market. So they decided to strip Burbn down to its photo, commenting and "liking" functions (all popular features among early Burbn users) and rename it to Instagram, a portmanteau of "instant camera" and "telegram".

After a few months of development and testing, the Instagram iOS app launched on 6 October 2010. Twitter, Tumblr and Facebook feeds around the world quickly became inundated with Instagram images. At the end of the first day, it had 25,000 users, and by the end of the first week that number rose to 100,000. By comparison, it took Foursquare seven months to get 60,000 users.

By mid-December, Instagram hit one million users.

On 22 July 2011, with nearly seven million users, Instagram experienced next-level virality. In fact, its servers went so ballistic that the team thought they were under DDOS attack. But no, it was Justin Bieber tweeting out his first picture to his 11 million Twitter followers. His manager subsequently reached out to Instagram arguing they should pay him for the privilege. Systrom stood firm and said no. Bieber kept using Instagram.

Fast forward to March 2012 and, as the Biebz hit one million Insta followers, Instagram was being eyed-up by Facebook and courted by Twitter for an acquisition. Dorsey reportedly made an all-stock offer worth around $500-700 million, which Systrom rejected.

A few days later, as the founders were deep into negotiations with Sequoia for a $50 million venture round at a $500 million valuation, Zuckerberg went in for the kill offering $1 billion for the company - $300 million in cash and the rest in Facebook stock.

Remember Instagram had no revenue at this time. Only insane user growth—25 million and climbing—achieved with a tiny a team of 13. Thanks to private emails published recently as part of a historic antitrust hearing, we now have clearer insight as to just how much of a threat Instagram was seen to pose to Facebook. Zuckerberg had decided it needed to be neutralised, no matter the cost.

The deal sent the tech world spinning (us included). In 2012, $1 billion was considered a massive price. It was the biggest deal Facebook had ever done. What’s more, it soon came out that the deal was done over a weekend, behind the Facebook board’s back - they were “told, not consulted” (one of the benefits of a founder controlling voting rights). Facebook was preparing to IPO at the time and Wall Street didn’t think favourably of this type of behaviour:

These sorts of fast decisions, commonplace among scrappy, private start-ups, get trickier in the more structured world of multibillion-dollar public corporations where Facebook will soon operate.

Now with the benefit of hindsight, we can see that the acquisition was an excellent strategic move, even with a $1 billion price tag. In 2018 Instagram reached 1 billion monthly active users, prompting Bloomberg to estimate that Instagram would be worth $100 billion as a standalone company. 100 times its 2012 investment.

Aside from price, the Instagram acquisition also made history thanks to Zuckerberg’s promise to the founders that Instagram would retain near-total independence. Many credit Zuckerberg for starting this trend in the tech world and suggest that Facebook would never have been able to acquire WhatsApp or Oculus had it not been for Instagram’s post-acquisition independence.

But all great things have their expiry date. Instagram’s independence included.

According to this meaty piece by Wired and a book released in April - Sarah Frier’s No Filter: The Inside Story of Instagram - Zuckerberg gradually started to exert his control and dominate his ego over Instagram, forcing the two founders to quit in 2018. A few examples:

By refusing to allocate further separate resources, Facebook gave Instagram no other option than for Facebook to take over content moderation and policing user behaviour as Instagram grew.

After Systrom participated in magazine profiles, Zuckerberg puffed his chest and declared that future features would require permission from him or Sheryl Sandberg.

In an earnings call in July 2018, Zuckerberg took credit for Instagram’s success: “we believe Instagram has been able to use Facebook’s infrastructure to grow more than twice as quickly as it would have on its own.”

While Systrom was on paternity leave, they began testing location tracking and added a hamburger button inside Instagram, linking to Facebook notifications - design decisions that Systrom would never have allowed.

Ultimately, Instagram and Facebook did an incredible job post-acquisition. For the most part, Instagram was left to run free with its own culture, purpose and design ethic for six years - a long time in the tech world. And Instagram has ensured that the Facebook group remains relevant. As Facebook’s growth has started to stall, Instagram continues to attract new users, particularly amongst the younger demographic.

Instagram’s growth rate now pales in comparison to TikTok, which has passed Instagram as second-most popular social app for U.S. teens behind Snapchat according to a report released this week.

VCs are on the hunt for the next big social app. The future is thought to be audio, as investors pour millions into Clubhouse, Chalk, Geneva, Orbit, Betty Labs, Rodeo and Spoon. Audio and text app Discord was last valued at $3.5 billion in July - two months before it saw a huge spike in downloads thanks to the kids going crazy over a new game, Among Us, that requires users to talk to teammates to win.

Meanwhile, regulators threaten to break up Big Tech. Instagram and Facebook could be a natural first step. So Zuckerberg is busy doing all he can to make that separation difficult - tightening up Facebook’s integrations with Instagram (and Whatsapp) and removing its independence.

Bonus read: This is an excellent First Round Review piece on growth tactics for consumer startups.

Celebrating Australia’s Innovation Station

The winners for the AFR BOSS Most Innovative Companies have been announced! We had a hunt and couldn’t find any snapshots of the winners with a quick explanation of their innovations. So here you go - our top picks:

Property, Construction & Transport: Mirvac. Rather than manually monitoring the progression of a site, Mirvac’s BuildAI platform transforms a live camera feed into real time safety, quality assurance and predictive project outcomes.

Technology (side note: kind of weird that this is even a category considering everything on this list is/involves “technology”): Split Payments. Split is “the world's first open banking, real-time settlement payments platform”. Its instant account verification feature allows you to digitally onboard and verify a customer’s bank account in a matter of seconds.

Banking, Superannuation and Financial Services: CommBank - Vonto helps small business owners make better, data-driven decisions by connecting key business tools in one platform (e.g. Xero, Google Analytics, Shopify, Instagram, Facebook and Vend).

Manufacturing & Consumer Goods: Bluey Technologies. Its BluCem ZeoGlass is an acid resistant concrete made from 60% recycled materials, which can withstand aggressive environments, such as sewers, for up to three times as long as regular concrete.

Retail, hospitality, tourism and entertainment: eStore Logistics. The company’s robotic and AI-enabled ecommerce order fulfilment supports both Temple and Webster and Kogan.com.

Health: Arriba Group’s Digital Wellness Platform has a series of programs and tools to help people manage their mental health, including CheckIn Today, which is designed to pick up and address mental health issues early.

Special shout out to 3rd place - our friends at Bodycare Workplace Solutions. Their COVID-19 Daily Health Check app is a practical way to screen for potential signs and symptoms of COVID-19 and helping to identify when people may not be well enough to go to work.The Best Pandemic Pivot: PACT Group for their Pivot into Hand Sanitiser. Within six weeks, Pact went from importing 10,000 units of hand sanitiser per month to manufacturing 1.5 million litres of hand sanitiser per week.

Well done everyone!

The Deloitte Fast 50 nominations close next week, FYI.

Rapid fire: News that caught our eye this week 🧐

Australia and NZ:

Vistaprint will acquire 99designs, a marketplace for designers. Pioneers of the crowdsourced marketplace, serial entrepreneurs Dax and Matt created a whole new category when they cofounded 99designs in 2008. Bootstrapped until a $35 million monster Series A by Accel in 2011 (also the year Patrick Llewellyn took over the helm as CEO), 99designs is a great example of a Melbourne-founded startup going global from day one. Congrats team.

Blackbird led a $1.7 million Seed round in Christchurch-based startup, Partly. Automotive parts are hard to sell online, partly because the product data is so complex. To help solve this, the team have developed two products: PartsPal, a SaaS inventory management system for auto parts businesses that integrates with ecommerce platforms like Shopify, Trade Me and soon, eBay and Amazon. And they’ve developed their own online marketplace for auto parts, Partly.

Nura is getting into gaming with a boom mic accessory for its nuraphones. Big bizniz.

Recognising that its Gen Z customers, in particular, care about sustainability and are concerned about a brand’s transparency, Afterpay is partnering with Aussie-founded sustainable and ethical brand rating directory Good On You, which counts actress and activist Emma Watson as a supporter.

Online retailer, Adore Beauty lodged its prospectus for its upcoming ASX listing, valuing the company at nearly AU$615 million. Revenues for this CY are forecast to grow 76% to $158.2 million and EBITDA double to $6.4 million. Founder, Kate Morris pointed out:

This will be the first ASX listing of its size with a woman founder and woman CEO. (Not to mention CFO, and COO, and majority women on the board)

Adore’s valuation “has raised eyebrows in the market”. Yet MyDeal, an online marketplace listing soon at a $259 million valuation with FY20 revenue at just $15.8 million and EBITDA of $670k, escaped the same level of critique.

Pre-launch neobank Douugh listed on the ASX with a AU$6 million Series A… probably just enough to cover the bankers and ASX fees.

iSelect reached a settlement with the ACCC in relation to misleading thousands of consumers over electricity tariffs, resulting in a AU$8.5 million fine. iSelect showed a limited number of options on its website, with cheaper plans available via its call centre - but it failed to make consumers aware of this fact. It also underestimated the cost of some plans. iSelect said it didn’t intend to mislead consumers, in part blaming a “coding error”. This is a timely reminder: if your legal, marketing and product teams aren’t working closely and engaged in constructive debate about promotional material, you’re probably doing it wrong.

Around the world (all in USD):

The battle of food delivery apps is heating up! Uber Eats (which in Q2 was bigger than Uber in terms of adjusted net revenue, but not EBITDA) is expanding its delivery service beyond food to deliver everything from flowers to pet supplies. Instacart, which delivers grocery and home essentials in an hour or less, raised another $200 million at a $17.5 billion valuation. This comes after it raised $225 million in June and $100 million in July at a $13.7 billion valuation. GoPuff, another U.S. startup that delivers products like medicine, baby food and alcohol in 30 minutes or less, raised $380 million at a $3.9 billion valuation.

Cryptocurrency exchange company, Coinbase’s CEO Brian Armstrong spurred debate within the tech industry (this is a great summary) stating it won’t take any political stance and won't permit any company-wide discussions not related to its work. It offered employees an exit package if they no longer felt aligned with the company's culture. About 5% of its employees left as a result. 1 in 20 is a lot of people considering the current uncertain hiring environment.

Facebook expanded a ban on QAnon-related content on its platforms - now purging “any Facebook Pages, Groups and Instagram accounts representing QAnon”, labelling it a “militarized social movement”. We wrote about QAnon in June - interwoven pro-Trump conspiracy theories that have taken root as a “collective delusion” around the world.

Google released new logos for G Suite following the announcement of its rebrand as Workspace. From ditching the iconic Gmail envelope logo to removing the distinguishing features of the individual logos, it’s bad. This dude agrees.

In case you didn’t know, Barbie is an influencer. In her latest vlog, Barbie and her pal Nikki unpack racism “in a two-minute video that is so simple, both children and your racist uncle can understand it”:

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

p.s. We love feedback - if you have any or want to continue the conversation, please reach out.

p.p.s. Watch Gavin live on AusBiz at 2pm on Mondays, when he opens the Startup Hour of Power.