Weekly Wrap #34: The month that was Jan 2021

Long time no see. We have so much to catch up on!

If you love the Weekly Wrap, please share away.

Seen any interesting startups? Have any tips for the Weekly Wrap? Want to indulge our inner-journalists? Drop us a note.

Want your app to take off? Ask Elon Musk for help

Move over Kim Kardashian, Elon Musk has broken the internet in more ways than one this year. And it’s only the start of February.

First, Signal

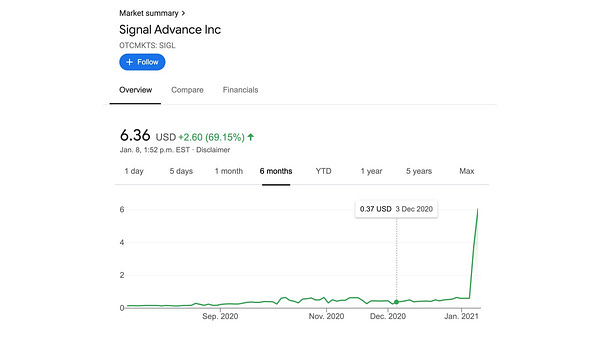

On 7 Jan, Musk delivered an ominous tweet: “Use Signal”. To which some of his 42 million followers interpreted to mean “invest in Signal”, sending Signal Advance Inc’s share price soaring by more than 11,700% in three days.

Alas, he was not giving the next Reddit-fuelled GameStop tip (please read here if you have never heard of GameStop/GME). Instead he was urging people to switch away from WhatsApp to Signal, an encrypted messaging app created by a private company.

This follows a controversial change to WhatsApp’s privacy policy that will see personal data (including your name, number, IP address, transaction information) shared with Facebook for advertising. The change was due to take effect from 8 Feb, but has subsequently been delayed due to consumer backlash.

Fear not, Musk’s message was not lost on everyone. Signal’s download rates exploded following the tweet:

Source: Appfigures

Next, Clubhouse

The new social media ‘it girl’, Clubhouse, has gone mainstream in part thanks to Elon Musk’s appearance this week.

Clubhouse is a voice-based social networking app that is invite-only (similar to an elite country club, members get to invite a limited number of friends) and hyped as the next Twitter or Snapchat.

It’s like a conference panel session, house party and boardroom/town hall tied into one audio product. Or as Editor-in-Chief of tech publication The Verge describes, a tech conference with none of the benefits:

We first heard about Clubhouse back in April when it started to blow up within VC circles. With just a few thousand users onboard at the time, Clubhouse managed to run a highly competitive seed funding round that pitted two of Silicon Valley’s best-known VC firms against each other.

Andreessen Horowitz won. The deal included $10 million in primary capital and at least $2 million in secondary shares (shares bought from existing shareholders), and valued the company at over $100 million (post-money).

Zoom forward 8 months and Clubhouse is valued at $1 billion, after raising a further $100 million.

Wait, what, how? Well, a magic combination of: successful FOMO tactics + ideal timing (given Covid’s impact on the conference and events industry) + hockey stick growth + high retention rates + experienced “charismatic, energetic [co]founder” known to the VC partner for nearly a decade = many money.

This week Elon Musk decided to get in on the mix. He casually jumped onto Clubhouse to answer questions all things Mars, crypto, space and vaccinations. Then he took the role of interviewer with an “unplanned” grilling of Robinhood’s cofounder, Vlad Tenev, just days after the company hit headlines for its role in the $GME and $AMC rally.

The chat broke Clubhouse’s 5,000 person room limit and spilled over onto YouTube. Demand for Clubhouse has since skyrocketed. There’s now a market for invitations on Reddit, eBay, Craigslist and, despite the app not being available in China yet, Idle Fish (Alibaba’s secondhand marketplace).

Oh, and it also coincided with a 116% rise in the share price of publicly traded Clubhouse Media Group Inc (not at all related to Clubhouse).

Source: Vajresh Balaji

Top tip: If you’ve got an iOS device, a Clubhouse invitation or friends in the know, check out the StartupAus ‘Aussie Startups’ chats on Tuesdays 6pm or tune in on Thursdays 8pm for ‘Startmate After Dark’.

Aussie founders kicking goals

Brisbane-founded workforce scheduling startup Skedulo won a major role in California’s Covid-19 vaccination roll out, in partnership with Accenture and Salesforce:

[The trio have] developed a statewide system called My Turn that will allow residents to learn when they are eligible to be vaccinated and find a place to make an appointment. It also will provide a way to track vaccination data.

Melbourne-based sports video game maker Big Ant Studios has been acquired by French-based Nacon in a deal worth up to €35 million. Big Ant is best known for sports games including AO Tennis, Rugby League Live, along with various cricket and AFL games. The studio also worked on hugely popular games such as Fruit Ninja (a personal fave) and The Legend of Spyro.

Melbourne-based personalised genomics startup myDNA announced a merger with Houston-based consumer DNA test group FamilyTreeDNA and Gene by Gene. myDNA’s founder Dr. Lior Rauchberger will step into the role of CEO of the merged companies. The two businesses come together as one of the leading global experts of genealogy, pharmacogenomic and nutrigenomic services.

Atlassian crossed US$500 million in quarterly revenue for the first time. It achieved 23% YoY growth and added 11,617 net-new customers, bringing its total count to 194,334.

The first neobank has sold out - NAB is acquiring 86 400 in a $220 million deal.

Media turns VC. VC turns media.

The Australian Media Code saga continues *face palm*. Google has offered to pay media organisations to host content within its new product, News Showcase, while also threatening to withdraw its search product from Australia. Nine has rejected the offer. Microsoft says it will be willing to live by the proposed new rules. Of course, because no one uses Bing.

Chiming in on the topic, Atlassian published a set of eight principles that it wants the government and regulators to consider and test before passing laws. These include sensible ideas like: Engage with the issue [by understanding the technology]. Treat the ailment, don’t kill the patient. Consult early, consult openly.

Pay day’s coming for Seven West Media, who will likely exit two of its investments via IPO. Seven West is the biggest investor of online jobs board Airtasker, which is expected to list on the ASX in March. If successful, Seven West will receive about $50 million for its stake. Another portfolio company, digital lender SocietyOne is rumoured to be eying an ASX listing later this year.

Meanwhile VC is turning into media. One of the world’s biggest VCs Andreessen Horowitz announced it is building a new and separate media business.

Local & distantly-related capital raising

Felix led the way with the first tech Aussie IPO this year. The construction tech company raised $12 million and currently has a market cap of around $47 million.

Myia Health closed a Series A bridging round led by Movac. The company has developed a data-driven virtual health care platform that uses a combination of IoT technology, daily patient surveys and telehealth technology so that doctors can monitor elderly and chronically ill patients from home.

AgriWebb raised AU$30 million. AgriWebb's farm management platform now monitors 15% of Australia’s cattle and sheep stock.

Airspace raised US$38 million, led by Telstra Ventures. Airspace provides time-critical logistics and delivery services for industries such as healthcare, aerospace and high-tech machinery.

Data analytics company Phocas raised AU$45 million from Ellerston Capital and OneVentures.

DroneDeploy raised US$50 million led by AirTree and Energize Venture Capital, following on from a US$50 million capital raising in 2019. Using drones, robots and 360-degree cameras DroneDeploy can capture data from inside and outside buildings entirely autonomously and remotely - ideal for construction, mining and agriculture.

BNPL Scalapay raised AU$63 million to fund its European expansion.

While we’re on the topic of BNPL, the UK will regulate the BNPL industry because of a “significant potential for consumer harm”. Use of BNPL products nearly quadrupled in Britain in 2020, taking total lending to £2.7 billion. More than 10 per cent of British customers are in arrears.

Fast raised US$102 million, led by Stripe and Lee Fixel’s (former Tiger Global investor) Addition.

Other smaller raises: ConstructionTech startup Matrak raised nearly AU$6 million. Studiosity raised AU$10 million PE money. DesignCrowd raised AU$10 million. 'Xero for compliance' platform, 6clicks raised AU$5 million. Consumer data platform Adatree raised a AU$1.2 million seed round.

Happenings around the world (USD)

Tim Cook and Mark Zuckerberg’s feud is escalating. In August Apple announced plans to require iPhone apps to ask users for explicit consent before tracking them for advertising purposes - an “opt in” regime. Of course, given Facebook’s business model is reliant on troves of personal data, it loudly protested that the update would decimate its and other developers’ ad revenue.

Fast forward a few months and the two CEOs are blasting each other in earnings calls and conferences. In one corner you have Zuckerberg accusing Apple of making “misleading” promises about its privacy practices. Facebook is also said to be preparing an antitrust lawsuit against Apple. In the other corner, Cook took a giant, public swipe at Facebook:

The fact is that an interconnected ecosystem of companies and data brokers, of purveyors of fake news and peddlers of division, of trackers and hucksters just looking to make a quick buck, is more present in our lives than it has ever been. Technology does not need vast troves of personal data, stitched together across dozens of websites and apps, in order to succeed.

Shots fired. Here’s a great piece by Wired breaking down the underlying motivations by both companies.

UK high street casualties = ecommerce gains. Boohoo bought the Debenhams brand for £55m. ASOS bought Topshop and Miss Selfridge brands out of administration for £330m.

Always a deal to be done. Uber is buying alcohol delivery service Drizly for $1.1B. Citrix acquired project management platform Wrike for $2.25 billion. AppLovin is acquiring Adjust for nearly $1 billion.

Musings of a failed successful entrepreneur. Serial entrepreneur and investor Justin Kan—also the cofounder of hugely popular Twitch—reflected on the failure of his ‘new law’ startup, Atrium. Atrium shut down in March 2020 after raising $75 million over three years from high profile VCs including Andreessen Horowitz. Our favourite learnings (coincidentally we often help founders with all of these challenges):

Adding more money to a situation of lack of product market fit rarely works.

Ability to frame strategy and communicate it is rare and requires experience.

[We] should have asked “who are we building for?” much more specifically and ruthlessly iterated for them.

Public markets are (still) hot, hot, hot

BNPL Affirm listed on the Nasdaq on 13 Jan. Affirm postponed its IPO last year due to concerns of mis-pricing following the craziness that was the DoorDash and Airbnb IPO pops. Despite this, it saw its share price soar nearly 100% on the first day of trading. Here in Australia that coincided with a dramatic increase in Zip and Afterpay’s share price.

Online gaming platform Roblox also scrapped its plans to IPO late last year and will instead complete a direct listing. As will Coinbase.

“Experience management” platform Qualtrics completed an IPO on 20 Jan at $30/share and is now trading around $55. SAP acquired Qualtrics in 2019 (three days before a scheduled IPO) for a cool $8 billion. Its stake is now worth over $20 billion.

Dating app Bumble is expected to IPO next week. Founder and CEO Whitney Wolfe Herd (also co-founder of Tinder) is the youngest US woman to lead a company through IPO and the board is comprised of 73% women.

Hims & Hers, a healthtech startup listed on the NYSE via a reverse listing (or as people in the US like to call, SPACs). FinTech Payoneer and DNA-testing firm 23andMe are just a few other companies set to go public via this route soon.

Kuaishou, a Chinese video app, completed a mammoth IPO in Hong Kong. The app rivals TikTok, with 481 million monthly users.

In the UK, online card retailer Moonpig floated on the London stock exchange on Tuesday, valuing the company at around £1.2 billion. We may see Deliveroo, Transferwise and Darktrace list in the first half of this year too.

Departing words from the world’s richest man

After 27 years at the helm, Jeff Bezos is stepping down from his role as CEO of Amazon. Leaving on a high note after the company hit its first ever $100 billion quarter, this was his closing message to Amazon’s 1.3 million (!) employees:

Invention. Invention is the root of our success. We've done crazy things together, and then made them normal. We pioneered customer reviews, 1-Click, personalized recommendations, Prime's insanely-fast shipping, Just Walk Out shopping, the Climate Pledge, Kindle, Alexa, marketplace, infrastructure cloud computing, Career Choice, and much more. If you get it right, a few years after a surprising invention, the new thing has become normal. People yawn. And that yawn is the greatest compliment an inventor can receive…

Keep inventing, and don’t despair when at first the idea looks crazy. Remember to wander. Let curiosity be your compass. It remains Day 1.

There you have it. Go forth and invent.

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

www.ignitionlane.com

p.s. We love feedback - if you have any or want to continue the conversation, please reach out. Gavin is back on AusBiz at 2pm on Mondays, when he opens the Startup Daily TV show.