Weekly Wrap #4: Monopoly Money, Kingmakers and Kidfluencers

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

You might have heard about a little deal Joe Rogan and Spotify made recently that sent Spotify’s market cap soaring by US$6B+ in four days. We think the deal is interesting because of the questions it poses:

Why did it cause such a big stock market reaction?

Does this signal the next round of content wars?

How did Joe Rogan get such a big following?

We dive into each of these in this week’s wrap. Read on to find out more!

Spotify’s $6B steal

First, a bit of background (skip if you’re familiar with the deal).

On 19 May Spotify announced it had acquired exclusive rights to the podcast “The Joe Rogan Experience” (JRE). We don’t know the exact terms of the deal, but the WSJ suggests that it’s worth well over US$100 million. Ted Gioia (musician and critic) mused that “a musician would need to generate 23 billion streams on Spotify to earn what they’re paying” for JRE.

Never heard of Joe Rogan? He is an ex-Fear Factor host, comedian and MMA commentator. On JRE, he interviews anyone and everyone - including Edward Snowden, Elon Musk, Bernie Sanders, conspiracy theorists and alt-right fanatics - for hours on end. JRE is unscripted, raw conversation, which Rogan eloquently describes as “all freeballing”.

Rogan is clearly giving the people what they want. JRE is considered to have the biggest podcast reach in the world (particularly true if your definition of the world = the USA). In 2019, JRE reported over 190 million podcast downloads a month and each episode now attracts between 2 and 14 million YouTube views. For context, Spotify has 286 million+ daily active users. So JRE is a big deal. One could argue he got ripped off.

JRE will start appearing on Spotify for the first time ever in September, and exclusivity will start later in the year.

Elon Musk broke the internet and caused Tesla stock to temporarily drop 9% when he took a puff of cannabis on JRE in 2018. Don’t worry, he’s still making progress getting humans to Mars.

Spotify’s aggregation end game: monopoly money $$

One or two posts hypothesise that the JRE deal is about much more than increasing its current subscriber base. They’re long, but worth the read if you want to geek out. Otherwise, here’s our short version…

The aggregation strategy

In the 00s, Google/Alphabet created a monopoly out of search (Google), online video (YouTube), and maps (Google Maps). Facebook did the same with social networking (FB, Instagram, Whatsapp). The ultimate prize for these companies is ad revenue. Own the audience, control billions of dollars of ad spend.

Big Tech has been trying to mirror this aggregation strategy ever since. But music streaming has proven to be impossible to monopolise. No one platform has been able to dominate - they’re all directories with similar catalogues, not gatekeepers of exclusive content.

The podcast market, on the other hand, is open and up for grabs.

Enter Spotify

Spotify has a lot to gain by aggregating (aka monopolising) the podcast market. Its current business model has significant marginal costs (ie the royalties it pays the music industry) and it is fast approaching a profit ceiling if it doesn’t expand out of the music biz. If Spotify can control the podcast market, not only does it get additional audience subscriptions, it also wins the grand prize: monopoly ad revenue. Win².

So the theory goes, Spotify has been spending up large (an estimated US$700 million since 2019) rolling up the podcast market with this monopoly end game in mind. The JRE rights acquisition, and the huge audience that it should bring, may signal a massive turning point in Spotify’s future.

The competition - AAA

Amazon, Apple and Alphabet let their guard down. Now Spotify has a big head start, but it also has a long way to go. Neither the indie/open podcast ecosystem nor the big platforms are likely to give up without a fight.

Apple is Spotify’s most likely contender, but it seems a bit preoccupied building its TV empire at the moment (see next post). The JRE deal is also a slap in the face for Alphabet - JRE created a podcast culture on YouTube that he’s abandoning (more on that here).

For those of us not running multi-billion-dollar monopolies, this still serves as a good reminder that even the disrupters can get disrupted. Don’t get caught up in your own bubble. Always keep your finger on your market’s pulse.

We think we’ve only seen a glimpse of what’s to come. Watch this space!

The new kingmakers

In 1996 Bill Gates predicted in his article, “Content Is King”:

Content is where I expect much of the real money will be made on the Internet, just as it was in broadcasting.

The JRE deal is yet another proof point that, 26 years later, the oracle is not wrong. Content is king, and ex-reality show hosts might be the next kingmakers for the big platforms.

Perhaps we’ll see bidding wars for podcast content, as is happening in TV/movie streaming. In the last few weeks, Apple TV has won major bids in Hollywood scoring Ridley Scott and a Scorsese/DiCaprio/DeNiro combo. Apple: 2 / Netflix: 0.

But content creation isn’t Hollywood’s only kingmaker play. We’re also seeing stars like Will Smith and Leonardo DiCaprio play leading roles in venture capital. In fact, one of Ashton Kutcher’s investment babies, video startup Loom, just raised a Series B led by Sequoia and Coatue - doubling Loom’s valuation in 7 months to US$350 million.

Sorry for the puns

How we consume information is changing

You may be wondering, how did a reality show host and MMA commentator build such a huge following? It’s an important question.

The answer lies in our changing media consumption behaviour. For many people, shows like JRE have become their mainstream media - this is a great NY Times article and interview with Joe Rogan diving into that topic.

So if our well-established adult behaviours are changing as a result of tech, what does that mean for our younger, digital native generations? Unsurprisingly, the data shows a stark generational divide in media consumption behaviour.

Online is everything for Gen Z (born 1996-2010) and Gen Alpha (born 2010-2025). Social media plays a fundamental part in their lives. It is their main news source. Anyone can become famous, even kids as young as four are becoming kidfluencers.

Online is borderless, so tapping into these generations is big business. We’ve recently seen this with the unprecedented adoption of media purposefully designed with Gen Z and Gen Alpha in mind:

Now one of the biggest games in history, Fortnight has 350 million players who played more than 3.2 billion hours in April (estimated 63 percent of US Fortnite players are aged between 18 and 24).

The HUGELY successful launch of Disney+ six months ago, which has gained 54.5 million subscribers - an estimated US$3.7 billion in annual revenue. For context, Netflix has been streaming since 2007 and now has just under 183 million subscribers. Related to the post above, Disney’s excellent content acquisition strategy played a big part in its launch success.

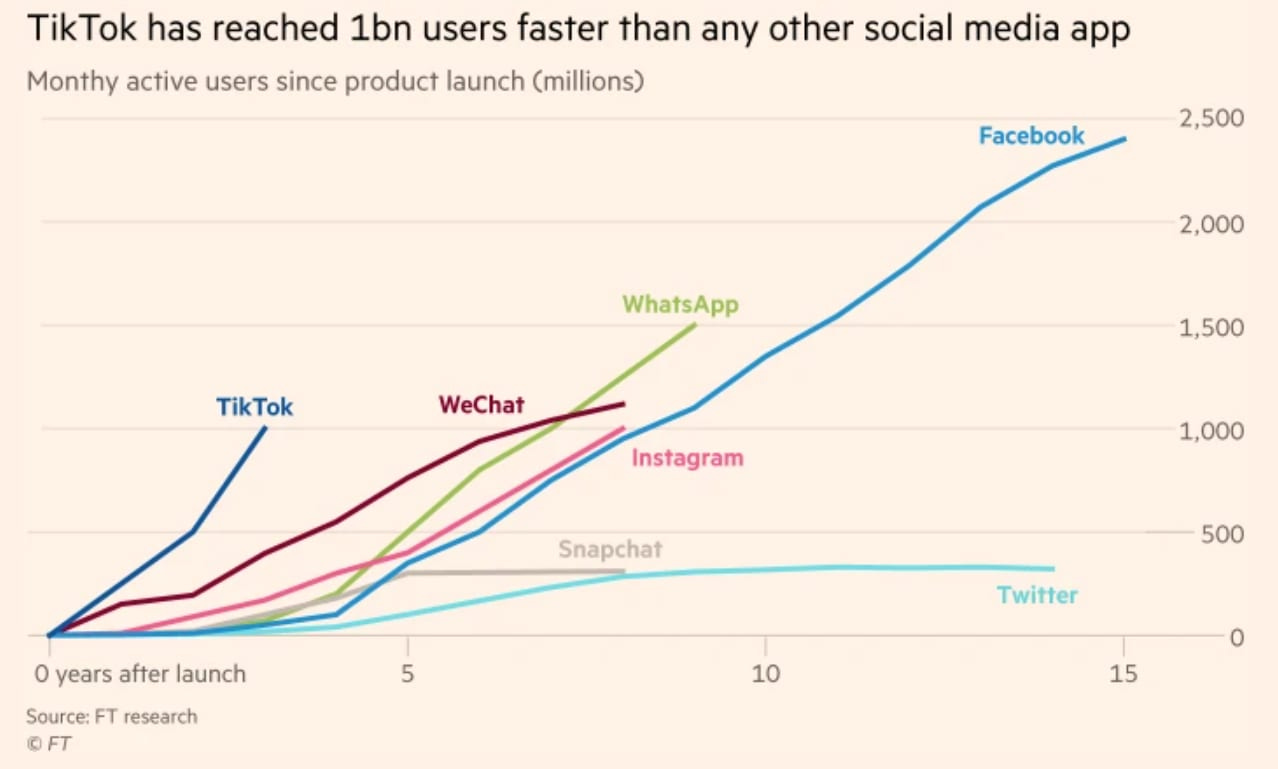

The explosive worldwide growth of TikTok since launching in 2016, which has reached 1 billion users faster than any other social media app. For a thorough overview of the meteoric rise of Beijing-based ByteDance (TikTok’s parent) - read this excellent post. Incidentally, ByteDance has just hired the exec behind Disney+ to be TikTok’s new CEO. Our crystal ball shows big changes ahead.

Gen Z and Gen Alpha are the start of something new. Anyone wanting to capture their attention must constantly adapt their go-to-market strategies to align to fast-changing habits, trends and expectations.

What’s more, these generations demonstrate that market power in one generation does not necessarily give you market power in the next. The size of your moat becomes irrelevant if the water dries up.

Bonus reading: McCrindle released an excellent report on the impact of COVID on Gen Z and Gen Alpha.

That’s a wrap! We hope you enjoyed it. Please share with your friends and reach out if you want to continue the conversation of any themes in this week’s wrap.

The team at Ignition Lane

p.s. we love feedback - if you have any, please let us know. Do you like this longer style? Should we keep it short? Mix it up?

🤔 Shower thought while writing this week’s wrap: In 1996, Bill Gates held the title Chief Software Architect. It’s funny how job titles have fads.