Weekly Wrap #50: CBA's grand plans, NZ's healthy hi-tech & a16z's AU debut

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

Please keep the great feedback coming. If you love the Weekly Wrap, share away.

Seen any interesting startups? Have any tips for the Weekly Wrap? Want to indulge our inner-journalists? Drop us a note.

Move over Apple, there’s a new ecosystem in town

Commonwealth Bank splashed some big cash this week, investing $30m for a 23% stake in online shopping site Little Birdie and $20m for a 25% holding in electricity retailer Amber (more on them below). Big valuations.

The investments reveal a bold and considered ecosystem play by CBA. It marks a departure from a previous reluctance to dabble in early stage startups - aside from a US$300m investment in BNPL Klarna (which is underperforming in Australia), an investment in R3 (blockchain) and the joint-acquisition of PEXA (which might be acquired for $3.1bn by KKR and Domain).

It also diverges considerably from Westpac’s Banking as a Service strategy.

Fintechs are increasingly targeting the most profitable parts of the banking value chain - Transferwise provides easy FX at better rates; Athena provides convenient, low cost mortgages; and Superhero provides a cheaper way to trade shares, for example. It could be argued every startup will be a fintech.

To protect its market share and create extra stickiness, CBA’s strategy is to leverage its existing customer base, customer data and brand recognition to offer products beyond banking. For instance, Amber will offer discounted rates to CBA customers, while Little Birdie will provide personalised shopping offers based on a customer’s transaction history.

The other half of CBA’s strategy is to acquire and launch fintechs to “help the core” of CBA under its x15 Ventures arm, which was launched last year. x15 has acquired or backed Doshii (point of sale integrations), Payble (business lending), Backr (business setup), Credit Savvy (credit scores), Vonto (business data centralisation) and Home-In (property buying services). To help startups operate within the regulatory and security constraints of the banking industry, x15 recently launched ‘xStack’, which it describes as “enterprise grade venturing in a box platform.”

CBA also invested US$10 million in to 2020 funds for both Square Peg and Zetta Venture Partners. Square Peg is an investor in Amber, too.

Will this strategy see CBA win out against the other big banks? If it’s well executed, then quite possibly. They’re moving fast and the market is happy - its share price hit an all time high of $100+. However, it does make a big assumption that consumers want their bank to be the centre of everything.

Regardless, it’s great to see the banks realise that (1) digitising the status quo isn’t going to cut it in the future; and (2) sometimes its best to leave new product innovation to independent teams.

Local news

Healthy hi-tech. Last night’s NZ Hi-Tech Awards showcased that NZ is punching well above its weight:

Hi-Tech Company of the Year: Fisher & Paykel Healthcare

Most Innovative Hi-Tech Hardware Product & Agritech Solution: Halter, a farm management tool

Most Innovative Hi-Tech Creative Technology Solution & Start-Up Company of the Year: Moxion, workflow for filmmaking used by the world’s leading filmmakers. Moxion was used on Oscar nominated films - Promising Young Woman, News of the World, Midnight Sky and Mulan

Hi-Tech Emerging Company of the Year: Whip Around, an inspections and maintenance tool for fleet managers

Most Innovative Hi-Tech Software Solution: Rocos, a robot operations platform

Most Innovative Deep Tech Solution: Nano Layr, which makes Nanofibre fabric made up of strands up to 400 times thinner than a single strand of human hair

Tough life. KPMG released the findings of its "Fitness, Fulfilment and Foresight" survey. It reveals that the majority of founders remain optimistic in the short term, although business uncertainty, finances and workload are a main source of stress. Founders are still struggling with physical fitness and want more “alone time”. Quick stats:

80% of Founders are early birds

31% work over 61 hours per week

27% haven’t taken any leave in the past 12 months

Speed looks like:

Skedulo won the Salesforce ISV (Independent Software Vendor) Partner of the Year - APAC.

Zip is acquiring two BNPL companies. It will pay $140 million for the remaining shares in European operator Twisto Payments and $21 million to buy out Spotti, which operates in the Middle East.

Robo investing for women. She’s on the Money podcast host Victoria Devine launched a ‘robo-advice’ investment app for her social media community of 170,000 followers in partnership with Six Park. The app targets millennial women and is a white-label version of Six Park, which uses algorithmic technology to automate investment recommendations. Devine and Six Park will operate under a profit-share arrangement.

Australia’s first SPAC. Brisbane-based electric vehicle fast-charger Tritium is set for a US$1.2 billion-plus listing on the NASDAQ via a SPAC. Its products can recharge an EV battery super fast—adding 20 miles in a minute or 100 miles in five minutes—ideal for public charging stations. Founder & Managing Director of Tiger Financial Group and ex-Reinventure partner Kara Frederick is on the Board.

Linktree launched a US$250,000 Passion Fund for entrepreneurs, artists and activists in partnership with Square.

Pizza tech. Yum Brands (a US parent company behind KFC and Pizza Hut) made a bid to takeover ASX-listed Dragontail Systems, valuing the company at $93.5 million. Its machine learning cameras monitor pizza quality and provides the technology behind Domino’s Pizza Checker, as well as its popular customer order tracker.

Xero raised its prices. A timely reminder for the founders out there: when did you last review your pricing?

Capital raising news

Buy Aussie Now raised $2.3m for its online marketplace, which launched 10 months ago. Just in time for Australian Made Week!

iVvy raised $7m in a pre-IPO round for its event and venue management software. The round was led by Thorney Investment Group and Gandel Invest. The Queensland-based company has already amassed more than 25,000 users across 14 countries.

Pyn raised US$8m led by US mega VC Andreessen Horowitz (its first investment in Australia - investment notes). This follows a US$2.2 million in seed funding led by Accel in July 2020. Pyn helps companies provide more targeted messages when communicating internally. Shopify, Rubrik and Carta are early customers. Pyn was founded by Joris Luijke who held VP of People titles at Atlassian and Squarespace and CultureAmp cofounder, Jon Williams.

FiberSense raised $11m from “a who’s who of the telco industry” who think that the FibreSense technology could be bigger than 5G. FibreSense is chaired by Bevan Slattery (the founder of iSeek, PIPE Networks, NEXTDC) and founded by former sonar research scientist and CEO Dr Mark Englund. The technology uses existing telecom fibre assets to detect and capture “minute vibrations given off by nearby objects”, which are transmitted to a centralised digital platform. This platform then processes this data to digitise, categorise, label and, if necessary, action the vibrations.

Artrya raised $15m. The company says it has developed the world’s first imaging technology to be able to accurately and quickly detect vulnerable plaque, which causes heart attacks.

Amber raised $20m from Commonwealth Bank. Amber is a green electricity retailer that provides consumers with access to wholesale prices, which are particularly cheap when renewables are plentiful (usually in the middle of the day and over night).

Little Birdie raised $30m from Commonwealth Bank… at a $130m pre-launch valuation! Little Birdie is the brainchild of Catch founders Gabby and Hezi Leibovich. The ecommerce startup wants to become the “new homepage of online shopping” and will have over 70 million products to track, search and compare. CBA will integrate selected shopping content from Little Birdie into the CommBank app. Little Birdie will also be given access to the bank’s 11 million customers.

mx51 raised $25m led by Acorn Capital, Artesian, Commencer Capital and Mastercard. mx51 was spun out from Assembly Payments and sats it is the the first Australian fintech to develop a bank-grade Payment as a Service platform.

Blackbird invested in Forte Global (investment notes - undisclosed amount). Forte is an education finance system designed to transition the unemployed into modern world jobs.

Christchurch-founded Dawn Aerospace raised an undisclosed amount from Movac. The investment will be used to scale the production of Dawn’s in-space propulsion products, and to progress Dawn’s Mk-II, a suborbital plane that utilises rocket engines, to a fully-fledged commercial service.

No stopping the freight trains - big tech news

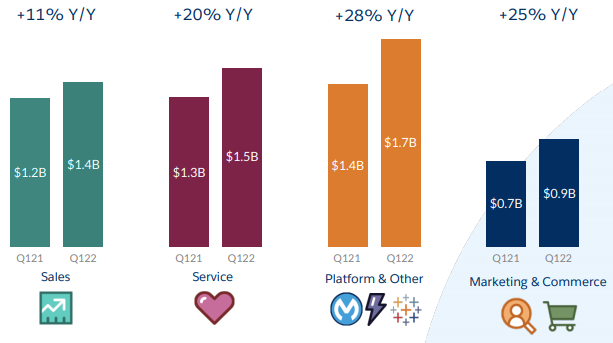

More trailblazing. Salesforce’s 1Q22 revenue is up 23% YoY to $5.96bn - an incredible growth rate considering it is bringing in $20+bn in revenue. It also increased its 2022 revenue guidance to a cool $26bn. That figure includes a contribution of $500m revenue from Slack (the acquisition is expected to close in July), plus $190m in revenue from Acumen Solutions (which it agreed to acquire in Dec 2020).

Founder and CEO Mark Benioff has created a truly impressive diversified empire thanks to some great acquisitions and ecosystem development.

Salesforce Ventures has now made over 500 investments, including in Athena Home Loans, Airwallex, Autopilot and GO1 here in Australia. This week it participated in Forter’s US$300m raise at a $3bn valuation (led by Tiger Global) and Qualified.com’s US$51m raise. Forter provides ecommerce fraud detection, while Qualified.com provides a conversational marketing platform purpose-built for companies that use Salesforce.

The company has nearly 60,000 employees and ranks #1 in Glassdoor UK’s “2021 Best Places to Work” and #2 in Fortune’s 2021 “100 Best Companies To Work For®”.

To nerd out more on Salesforce’s greatness, check out our Aug 2020 piece on Salesforce.

Amazon is buying MGM for nearly $8.45bn. Amazon, which has the world’s second-largest streaming service with 175m global users, won out against Apple and Comcast in the bid for the film and TV company. Following the $13.7bn it paid for Whole Foods in 2017, this will be Amazon’s second-largest acquisition to date. Amazon spent $11bn on content last year, while Netflix (who reportedly wants to become the “Netflix of games”) spent about $17bn. Amazon’s revenue for the first quarter of 2021 increased by 44% to $108.5bn.

On Tuesday, an Attorney General announced he’s suing Amazon on antitrust grounds, alleging the company’s pricing contracts with third-party sellers have unfairly raised prices for consumers and harmed competition.

Twitter raid. Police “visited” (some reports called it a raid) Twitter's offices after demanding that they explain why they'd labeled a tweet of the ruling party's spokesperson as “manipulated media”. An hour into the search attempt, the police vacated Twitter’s offices because they were closed and there were no Twitter employees at the premises (they’re all working from home).

🤯 Stripe has over 1500 job openings. It launched Payment Links this week (although Carted’s Mike Angell says Stripe made this tech back in 2015, it just got a fresh coat of paint and applied better product positioning).

Google’s inequality problem. Four women who were Google employees have won class-action status for their gender equity lawsuit, allowing them to represent 10,800 women. The lawsuit alleges that Google pays men nearly $17,000 more than women for the same work. Earlier this year Google agreed to pay $2.5m to employees and job applicants over alleged pay and hiring discrimination. It has also been in hot water over its treatment of two AI researchers who were women.

Epic v. Apple. A three-week-long Epic v. Apple hearing ended on Monday. Epic says that Apple abuses its market power in relation to the App Store. It ejected Fortnite from the App Store after Fortnite created a workaround to avoid paying Apple’s 30% commission. We may be waiting until August for the verdict. Who will win? If you go by Judge Rogers’ questioning, you’d put money on Epic:

But you could also monetise it a different way, couldn't you? I mean, that is, the gaming industry seems to be generating a disproportionate amount of money relative to the IP that you are giving them and everybody else. In a sense, it's almost as if they're subsidising everybody else.

In the meantime, you can read about secret deal-cutting with Netflix and discussions about whether bananas should wear clothes in court. Or perhaps ponder whether Tim Cook fudged his answer that he didn’t know how profitable the App Store was (it brought in more than $60bn in 2020 and the profit margin could be as high as 78%).

Crypto & other worlds

Iran is temporarily banning crypto mining after some of the country’s major cities experienced repeated blackouts. According to the BBC, Iran operates a program where Bitcoin miners must pay extra for electricity and sell their coins to the central bank.

AR NFT. Anima, an AR NFT platform got US$500k funding from Coinbase and others.

Israeli founded monday.com filed to list in the U.S. The filing shows revenue for the project management software company rose 85% to $59 million, while its net loss widened to $39 million from $19.9 million in the three months ended 31 March.

Virgin Galactic completed its third successful flight to the edge of space.

Monica Lewinsky won the internets.

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

If you aren’t subscribed to the wrap, sign up now: