Weekly Wrap #63: OnlyCorn's back, more on-demand snacks, and rockets SPAC

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

If you love the Weekly Wrap, please spread the word and help it grow:

Forward this to friends/colleagues by email or Slack

Share on the socials with a short note

Seen any interesting startups? Have any tips for the Weekly Wrap? Want to indulge our inner-journalists? Drop us a note: tipoff@ignitionlane.com

The little rocket that could

A big week for rocket SPACs.

On Monday Sir Richard Branson’s Virgin Orbit announced that it will go public via a special purpose acquisition company (SPAC). That deal is expected to raise US$483m, valuing the company at US$3.7bn.

Two days later NZ-US Rocket Lab went public, listing on the NASDAQ. The company merged with SPAC Vector Acquisition, which valued Rocket Lab at US$4.8bn and added US$777m to its war chest.

Rocket Lab was founded by Peter Beck, who has been rocket-obsessed since his school days in Invercargill:

“It’s always been about the rocket, there’s never been a question really – even at high school. I remember I failed a careers assessment test and they needed to talk to my parents about it. I was so defined about what I wanted to do and the test didn’t allow for that.”

He began seriously experimenting with rockets while working as an apprentice at Fisher and Paykel. In 2000, aged 23 (or 24?), he built a rocket-powered bike that blasted down a street in Dunedin accelerating from zero to 140kmh in just under five seconds.

In 2006 he founded Rocket Lab and, by 2009, it became the first private company in the Southern Hemisphere to reach space, after launching its Ātea-1 sounding rocket from Michael Fay’s* private NZ island (video below).

*For all you non-kiwis, Michael Fay was a banker infamous for his involvement in a 1990s scandal known as the Wine Box enquiry.

Today, Rocket Lab is considered the leader in the small launch space.

Its Electron rocket is the only reusable small launch vehicle currently on the market. Since its first orbital launch three years ago, it has carried 105 satellites to space, bringing in US$48m in revenue in 2019 and an estimated US$33m in 2020. It expects launch revenue to rise to $915m by 2027. By comparison, Virgin Orbit expects to bring in $15m this year and $2.1bn by 2026.

The latest cash injection of US$777m will help Rocket Lab grow its existing business and build a larger rocket called Neutron, which it unveiled earlier this year. Capable of sending around 8,000kg to low-Earth orbit, Neutron will compete against SpaceX.

The company has also been testing a new approach to recover and reuse its boosters. Using atmospheric friction and a parachute, the booster slows until a helicopter can fish it from the sky.

Beck, still at the helm of Rocket Lab, has achieved all this despite never going to university. He and the Rocket Lab team are an inspiration to kiwis and rocket-enthusiasts around the world.

But wait there’s more (ecommerce deals & shpiels)

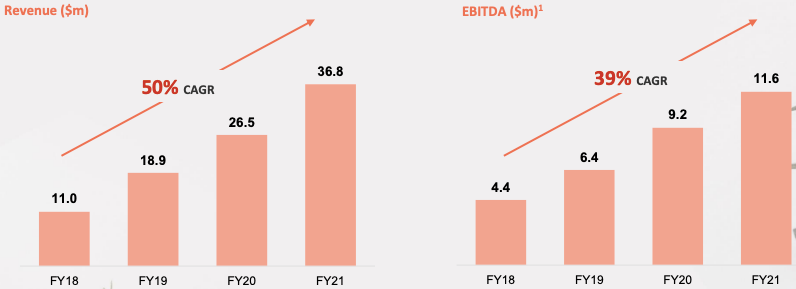

D2C Hero. BWX is acquiring a 50.1% of Go-To Skincare for $89m cash. BWX owns a suite of natural beauty and skincare brands and sites, including Sukin and Flora & Fauna. Go-To Skincare, founded by beauty expert Zoe Foster-Blake, has built a solid business centred around a direct to consumer (D2C) model. Its customer experience and branding is gold standard (aside from this), resulting in strong revenue & EBITDA growth (below). + Bonus mini analysis by Adir Shiffman here.

A deals deal. Global Marketplace (the company behind Click Frenzy) is acquiring GrabOne for NZ$17.5m. The GrabOne marketplace has more than 2,400 active merchants, and 300,000 members.

How convenient. The grocery delivery war is certainly heating up. Woolworths cemented a partnership with Uber to offer one-hour deliveries (a formalisation of the service it trialled in 2020). Geezy Go launched in Sydney, offering sub 20 minute delivery. And Send, which just started operating in Melbourne and Sydney, raised $3m from international investors.

If you read last week’s newsletter (The start of Aussie’s grocery delivery wars?), you probably think we have a crystal ball. You’re not wrong.

Little Birdie launched with a bang. Little Birdie (founded by Catch alumni) wants to become “the homepage of shopping.” The site, which holds pricing data for about 70 million products, helps customers seek out the lowest prices by providing detailed data on how an item has been priced at different stores and by offering exclusive discounts.

You want wine with that? Hospitality food wholesale marketplace, FoodByUs, announced it is expanding into alcohol after closing several big liquor industry partnerships. The marketplace was cofounded by Menulog alumni, and originally started life as a sharing economy platform connecting home cooks with members of the community.

ASX FY21 results stocktake

Kogan’s sales passed $1bn for the first time - gross sales were up 53% to $1.179bn. Revenue was up 57% to $780.7m, gross profits rose 61% to $203.7m, and gross margins hit 26.1%. However, due to logistics detention charges, excess inventory related costs, and the Mighty Ape acquisition, this growth didn’t translate through to its statutory results - EBITDA was down 86.8% to $22.5m, and NPAT down 88.3% to $3.5m.

MyDeal’s gross sales were up 111% to $218.1m, revenue increased 150% to $38.3m and gross profit up 119% to $33.3m. It reported a $4m EBITDA loss, citing investment in customer acquisition and its newer private label business. Q4 FY21 private label sales accounted for 5.2% of gross sales. It’s a big margin expansion opportunity.

Afterpay’s group income was up 78% to $924.7m. EBITDA was down 13% to 38.7m and its net margin as a % of underlying sales was down 0.2pp to 2.1%. It reported a $156.3m statutory loss. In the early weeks of the new financial year it has cracked 100,000 merchants.

Zip’s revenue increased 150% to $403m. Net margin as a % of underlying sales was down 0.3pp to 3.5%. Thanks to its aggressive acquisition activity and the purchase of US BNPL QuadPay last August, losses stretched to $653m. It also announced it will takeover of South African BNPL firm Payflex.

HiPages revenue was up 19% to $55.8m, 94% of that is recurring. Statutory EBITDA was $5.6m adjusted for one-off IPO related costs of $6.1m (listing is expensive, friends).

Local raising news. Trending: HealthTech

Seer raised $34m from Cochlear, EWM Group, SG Hiscock and Giant Leap. The company’s home-based epilepsy diagnostic service uses devices that monitor physiological signals (e.g. brain, heart and respiratory function) and behaviour to differentiate epilepsy from other conditions such as cardiac, sleep or psychological disorders. Its systems have been used to monitor over 7600 Australians, saving the health system over $100m and 140 years of bed-time. It plans to expand into the sleep and cardiac diagnosis space.

Quantum Brilliance raised $13m co-led by a consortium of Main Sequence and the founder of QxBranch. The startup aims to commercialise quantum accelerators the size of a lunchbox with over 50 qubits by 2025.

Quantum Brilliance uses synthetic diamonds to build quantum accelerators that do not require the near absolute zero temperature or complex laser systems that give other quantum computers a large physical footprint.

The smaller accelerators have the potential to accelerate the adoption of quantum applications by bringing the technology to a wider range of industries.

Carbonix raised $6.3m led by ASX-listed defence manufacturer Quickstep. Carbonix supplies carbon-fibre drones, flying and data collection services. It recently signed a deal with Ausgrid (the largest electricity distributor on the east coast) to map and monitor power lines, reducing its reliance on helicopters.

ezyCollect raised $6.2m at a rumoured EV of $38.4m in a pre-IPO raise. The account receivable management software helps around 1,000 customers manage more than $11 billion of receivables. Its ARR is approx. $4m.

Nutromics raised $5.7m led by Artesian. Nutromics is developing biosensor technology integrated into a wearable smart patch (like a “lab-on-the-skin”) for remote patient monitoring and individualised antibiotic dosing. The real-time information about drug exposure in a patient informs dosing decisions, which can lead to better patient outcomes and a reduced burden on the healthcare system.

The Nutromics team shared their lessons learned from the raise process - nice. Some interesting data points for ya:

Total Time Taken to Raise: 11 months

No. Investors We Attempted to Contact: ~200

No. Investor Meetings: ~100

No. Investors Committed: 19

No. Cornerstone Investors: 2

Oscer raised $5m led by Blackbird. According to research published by the Medical Journal of Australia, diagnostic errors occur in up to one in seven clinical encounters and more than 80% of diagnostic errors are preventable. To reduce these stats, Oscer is building a diagnostic support tool for doctors using automated transcription, coding and analysis of consults.

Send raised $3.1m for its 15 minute grocery delivery service.

Pi.Exchange raised $2.75m. Pi.Exchange describes itself as an AI-as-a-Service provider - its AI engine offers a faster, simplified and more cost-effective way for companies to build and maintain AI. It is targeting the banking and retail to professional services sectors.

HEO Robotics raised a seed round. HEO Robotics visually monitors satellites and space debris, helping satellite operators to monitor their space assets and assisting governments to understand space situational awareness. The funds will be used to release HEO’s inspection product for satellites, HEO Inspect, which helps to reduce space debris by troubleshooting known issues and preventing future failures.

In VC Land

Jelix Ventures raised $15m for a new early stage fund to invest in up to 20-25 startups focused on software and deep tech. The fund has already made its first investments in FL0, Quantum Brilliance and Bitwise Ag. Founder and CEO Andrea Gardiner and team are amongst an increasing number of people who are changing the face of VC funding - “Over a third of our existing portfolio have a female founder, and over 20% of our fund investors are female.”

VCs want you to join their startups. It’s a war for talent out there, especially in the world of tech. VCs are trying to help a brother out with jobs boards, talent networks and fellowships. This week AfterWork launched a new talent network. Blackbird did the same a few months ago. Innovation Bay (not a VC, but Jelix’s Investment Partner, Ian Gardiner, is a cofounder of Innovation Bay) recently launched a job board and are hosting a talent and team building mini series. Here’s a handy link to all the job boards.

Around the world

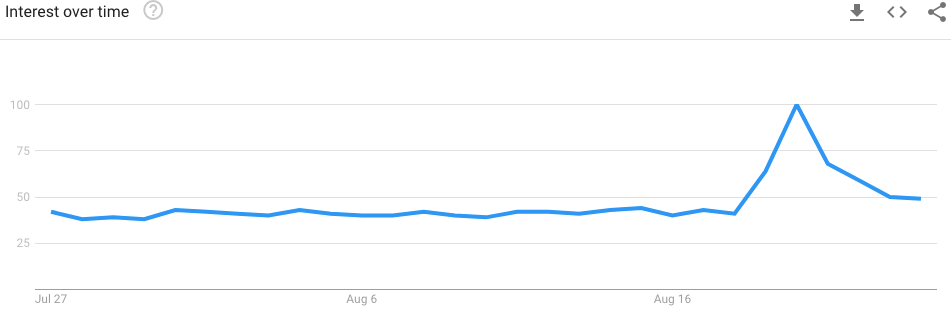

OnlyCorn returns (replace C with P). Fear not OnlyFan lovers, the company has reversed its stance from last week to ban sexually explicit content, saying it received “assurances” from banking partners that it can support payments its creators (who, let’s be real, are mostly sex workers). PR stunt? The ban generated tons of headlines, and renewed interest in OnlyFans around the world - check out the “OnlyFans” google search trend below - that peak is the ban announcement.

In case you’re interested, here are the top Australian cities searching for OnlyFans:

Two big Q2s:

China-based Xiaomi reported 87.8bn yuan revenue (US$13.56bn - up 64%) and 6.3bn yuan net profit (US$975m - up 87.4%) as its phone sales surged again in Q2, shipping 52.9 million units. The company wants to become the world’s largest smartphone maker in three years and move into electric vehicles. So does Apple.

Salesforce Q2 revenue grew 23% to $6.3bn. It expects to close the year out with $26.2 - $26.3bn in revenue. Only around 100 Salesforce employees are working in the company’s 61-story tower, San Francisco’s tallest building that has capacity for several thousand people.

Before we go… props to the growing list of businesses giving their team a paid day off or two to help reduce the pressures of lockdown (particularly with kids): Auror, AdoreBeauty, Carted, Linktree and CircleIn.

Heres a lockdown sport you can try:

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

If you aren’t subscribed to the wrap, sign up now:

Watch Gav on AusBiz at 2pm on Monday, when he opens the Startup Daily TV show