Wrap 100! Always be closing & IPO, no?

Welcome to our Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world over the past month.

If you love the Wrap, please spread the word and help it grow:

💯

We’ve officially made it to the 100th edition!

We started the Wrap in the throes of Melbourne’s first lockdown in May 2020, as another way to stay connected asynchronously (remember that buzz word?) with clients and friends.

At the time, our world’s economic future felt uncertain. People were learning to adapt to new ways of working, tech teams were squeezing a decade’s worth of digital transformation into weeks and months, and businesses across the board were cutting costs. History repeats itself.

Since then, the startup, tech and VC world has arguably undergone the biggest shift in history.

We saw the rise and fall of: NFTs, a crypto bonanza, Clubhouse, an obsession with product led growth, 10 minute grocery delivery, monstrous valuations, mega VC rounds and (occasional) poor due diligence. The number of VC funds exploded, and now many are grappling with how/whether to raise their next fund, or wind down.

Related: interesting piece on Tiger Global’s history.

Some things remained constant: Elon Musk’s domination of our newsfeeds, cyberattacks, remote/hybrid collaboration, the war for exceptional talent, high quality startup accelerator programs and government support for the local startup ecosystem. Being a founder or startup leader continues to be hard (we can help lighten your load).

And other things have intensified: Canva’s brilliance, the pressure to drive profitable growth, the growing talent pool of incredible people with startup experience ready to tackle the world’s biggest challenges - from climate change to healthcare, retail ad media and, of course, there’s AI and LLMs.

Our first Wrap featured some sage advice from Blackbird’s Niki Scevak, which is as relevant now as it was then:

economic shock should be a moment to look hard into the mirror.

What have you been kidding yourself about?

Now is also your greatest opportunity to change course, to confront your uncomfortable truths, and to seize a once in an economic cycle’s buffet of opportunities.

Wrap #1 went out to just 22 people. Now the Wrap reaches thousands.

Thank you for the love, the likes, the shares, the kind words and the critique. Keep it coming. We wouldn’t be here without you.

Local newsings

Canva turned 10. Cofounder and CEO Melanie Perkins shared her lessons from building the company. Fun Canva fact #1: Investors who put $1,000 into Canva’s first investment round would now have nearly $5m based on its latest valuation. Fun Canva fact #2: Early investor and former top Google executive, Wesley Chan, says Canva’s “competitive advantage lies in its ability to attract the world’s best engineering talent.” It receives more than 300,000 job applicants a year.

Employer’s market? New data from Seek shows tech job ads are down 35% compared to last year. Specialist tech recruiters say salaries and contractor rates have fallen up to 15% for some roles, although cybersecurity, cloud, data and AI remain in high-demand.

In need of a new skill? Check out 100 jobs of the future.

Fuelling the AI pipes. NextDC is investing nearly $1 billion into data centres to support extraordinary AI-related demand this FY. Business is booming. NextDC signed the largest amount of new contracts in its history during the 12 months to June 30, with customer numbers increasing 13% to 1,820. The company is forecasting revenue in the range of $400-$415m this FY.

Meanwhile, despite the number of visits to ChatGPT’s website falling for three months in a row, OpenAI is exceeding revenue expectations. It has already passed US$1b ARR.

♻️ to infinity and beyond. Samsara Eco unveiled $25m plans to create the nation’s first R&D hub dedicated to infinite recycling of plastic.

Crypto krakdown. ASIC launched legal action against crypto exchange Kraken, alleging more than 1,100 customers lost $13m on a product that didn’t meet regulatory rules. In other crypto news, US$41m worth of assets were stolen from Stake.com.

Winner winner. Melbourne-based (but US-founded) Startmate Winter ‘23 cohort company BioticsAI took home the almighty TechCrunch Disrupt Startup Battlefield Cup and US$100,000 this week.

BioticsAI has built an AI-based platform that plugs into an ultrasound machine to prevent fetal malformation misdiagnosis. The startup is able to identify fetus malformations with a high level of accuracy, validate the quality and completeness of the screening and then extract all the information to automatically generate reports.

Startup Daily held its Best in Tech awards, winners included: Most innovative: Q-CTRL (Quantum infrastructure software); New founder: Molly Fullee (wind-sensor technology that can help accelerate the transition to net zero); Sustainability: Goterra (fly maggot food waste munchers).

Quick things:

Poddy: Our friends Adam Schwab (Luxury Escapes CEO & Cofounder) and Adir Shiffman (Catapult Chair, investor) launched an excellent business podcast - The Contrarians.

Conference: Tank Stream Labs is organising the first Startup to Scaleup Summit in Sydney on Thurs 16 November.

Partnerships: BVP released a GTM guide to building SaaS channel partnerships. Bryan Williams shared key learnings from Partnership Leaders’ Catalyst Conference.

Lists: The Australian released its List of top 100 Innovators.

ABC: Always be closing

U.S. VC Lightspeed released its Sales Benchmark for 2023. Handy data points.

The tl;dr: Winning new deals is not only more difficult, it’s also taking longer -especially for US$100k+ price points.

In the first half of the year, 63% of companies missed their revenue targets. Even more concerning, 27% of those companies missed their revenue targets by more than 21%, indicating significant challenges. However, renewal rates have largely remained consistent.

Large transactions take time. US$250k+ deals are taking 6 months plus to close. Smaller transactions (under US$99k) are generally taking over 4 months.

Some top tips on surviving this market:

Deeply evaluate product market fit. In the current economic climate, only “must have” products will get through the buying process.

Focus on expansion opportunities, i.e. upsell or cross-sell existing customers.

Invest in sales enablement to improve productivity. Ensure your sales team understands a potential customer’s key priorities and pain points, and can adapt the product’s pitch to match the customer’s goals.

Ensure you are engaging the decision maker(s). Don’t get surprised to find you need the sign-off of multiple C-level execs.

Continually re-forecast revenue and revisit the sales pipeline. Take a conservative approach to (1) the probability of deals closing, and (2) modelling when new revenue will hit the P&L.

Local M&A & Venture News

Mr Yum and Me&u finally agreed to merge the two QR code ordering businesses in an all-stock deal.

Blackbird-backed US-based Fig was acquired by AWS to “enhance the developer experience” and help them to code faster.

Fitness startup Steppen was acquired by Alta.

Produce marketplace Foodbomb was acquired by hospitality ordering company Ordermentum. Ordermentum raised $16m as part of the acquisition, giving the combined business a $100m valuation.

Small business invoice lender Waddle has traded hands from Xero to CommBank’s X15ventures.

Xero acquired the lender in 2020 for $31 million, also offering an additional $49 million in earn out. But in March this year, just weeks after Sukhinder Singh Cassidy took over from Steve Vamos as Xero CEO, she wrote off the cloud-lending platform at a cost of up to $40 million as part of cost cutting measures.

AMP (founded by the people behind TradeGecko and Advocately, Cameron Priest and Patrick Barnes) secured US$18.5m (A$28.5m) for their ecommerce solution consolidating sales, shipping and analytics tools. AMP has already acquired three businesses to build out its functionality: checkout and conversion startup AppHQ, shipping platform Addition, and analytics tool Lifetimely.

The Victorian government’s $2bn investment fund, Breakthrough Victoria has backed five Victorian universities to help them better commercialise research, committing $43.5m in matched funding ($87m total).

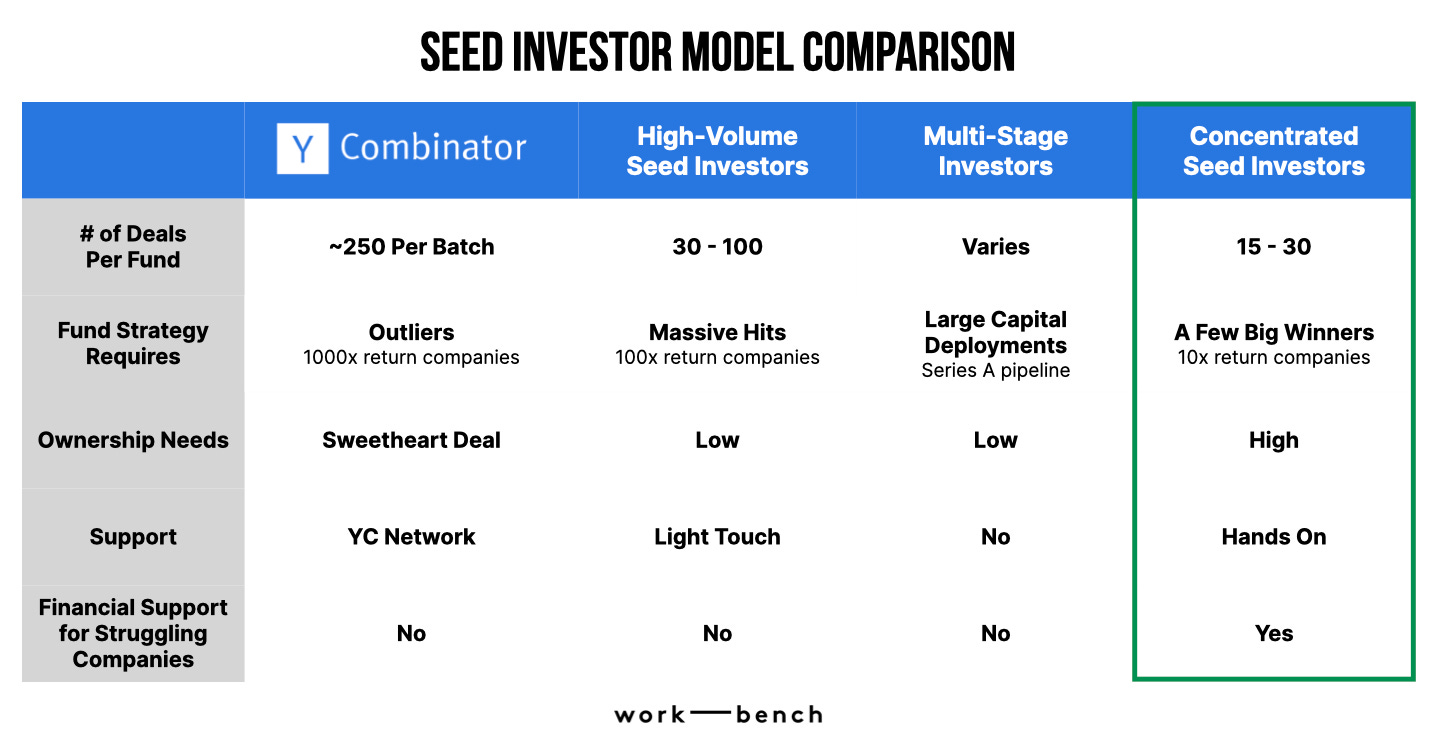

Good piece on different Seed investor biases and incentives:

Note, the above is US-centric. Equally, founders should be wary of expecting meaningful support from investors in ANZ. We find that the level of support you’ll receive depends on the individual Partner’s capacity and capability, as well as your startup’s growth trajectory.

Are big exists back? And other U.S. news

IPO, no? Over the last two weeks we saw the first big tech IPOs in aaaages - Instacart, Klaviyo and Arm. But no long-lasting pops, which leads us to questions whether the IPO window is really open:

On 14 Sept, Chip designer Arm priced its IPO at $51 a share ($54.5bn valuation) and surged as high as $69 on its second trading day. But the price has since fallen back down to $51. Arm’s FY23 revenue was $2.7bn and was flat from the previous year.

On Tuesday, grocery delivery/retail ad media firm Instacart sold its shares for $30 a pop in its IPO ($10bn valuation - well below its peak of $39bn in 2021). Shares surged 40% on the first day of trading, but the price then settled down to $30. It reported H1 2023 profits of US$242m and $1,475m in revenue.

In other grocery delivery news: Getir (might be last-man-standing in one-hour grocery) managed to raise another $500m round, though at $2.5bn vs $13bn in 2022. Also, the FAA cleared UPS drones for flight beyond line-of-sight. Early days, but this signals drone delivery could is on the horizon.On Wednesday, marketing automation firm Klaviyo also priced its shares at $30 (valuation of $9.2bn) in its IPO. It generated $473m in revenue last year, a 63% increase from the year prior, and now has 130,000 customers. Shares were up 10% at the time of writing.

Big exits back? Networking giant Cisco bought Splunk for US$28bn cash (a 30% premium to Splunk’s share price) to strengthen its cybersecurity and observability play for enterprises. This is the year’s biggest deal, as well as Cisco’s biggest acquisition to date.

Megarounds are getting rarer by the minute. Crunchbase reports that a majority of the $100M+ U.S. funding recipients are in the sustainability, AI or healthcare categories.

Apple went viral by turning a boring sustainability report into storytelling gold.

Apple’s future in China is starting to look a little shaky after the government has reportedly banned iPhone use for government employees at work, on security grounds. Almost all Apple hardware is made in China and the country also makes up 20% of revenue.

Casino heist. UNC3944 or Roasted 0ktapus is reportedly behind a cyberattack against Vegas casino giants MGM and Caesars. MGM experienced widespread system outages and service disruption, taking down hotel card keys, ATMs, gaming machines. Caesars also paid out $15m after a ransomware attack saw the breach of social security numbers, drivers licenses and other personal information.

1 video to rule them all

Looking back through the archives, the best video still remains: Lawyer to Judge “I’m here live. I’m not a cat.” I’m not a cat!

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

If you aren’t subscribed to the wrap, sign up now:

Seen any interesting startups? Have any tips for the Wrap? Want to indulge our inner-journalists? Drop us a note: tipoff@ignitionlane.com