Wrap #92: Rise & demise

Welcome to our Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world over the past month. If you prefer your news in video format, click here.

If you love the Wrap, please spread the word and help it grow:

Forward this to friends/colleagues by email or Slack

Share on the socials with a short note

Sunrise. Demise. No more pies.

Local newsings

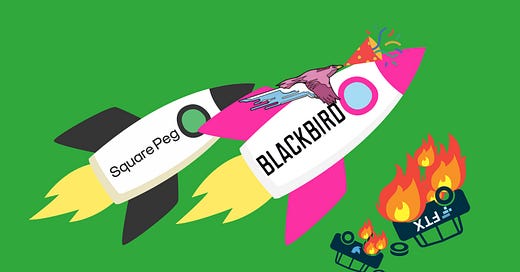

Record raises. Blackbird announced a whopping A$1bn raise - Australia’s largest VC raise to date. Square Peg raised US$550m for its fifth fund. VC Sprint Ventures closed A$8m for its second fund. SecondQuarter raised A$83m for its second secondary fund (this lets investors, founders and employees sell down shares before an exit or IPO).

Sunrise. ICYMI, the big theme at Sunrise 2022 (one of the best conferences in startupland) centred around preparing for slower economy and expensive capital:

Make sure FY23 & 24 financial plans include a recession scenario.

Many will find it hard to raise through 2023 and beyond. Some will need to consider alternative capital options, less founder-friendly terms and early exit strategies.

Related: a guide from A16Z on how to evaluate and decide on the best financing option for your startup.There may be record amounts of capital available, however VCs will have to make tough decisions on which companies they continue to back in 2023/24, given many won’t have stellar growth.

Despite all this doom and gloom, there’s fierce industry-wide optimism for the future. However not everyone is sold on Web3, yet.

$250m capsize. The ASX has (finally) abandoned a 7-year, $250m project to upgrade its clearing and settlement system to a blockchain-based platform, following a review by Accenture that showed “major deficiencies in the design of the software, developed by a company in which ASX has a stake, and questioned its ability to ever launch.” A classic case of corporate IT project problems + sunk cost fallacy, perhaps?

No more pies. Blaming a highly competitive, challenging market, Deliveroo entered voluntary administration in Australia. Menulog axed jobs at its Sydney HQ. Meanwhile, DoorDash has for some reason decided that expanding into instant grocery delivery is a great idea. This comes as Sydney-based Voly shut up shop, and global grocery giants Instacart, Gorillas, Getir and Zapp cut staff and reduce operations.

Crypto crackdown. ASIC launched court action against two crypto firms, Block Earner (offers a fixed-yield for crypto) and BPS Financial (issued Qoin tokens, a digital wallet and exchange), alleging they should have had a financial services license to offer their crypto products. Expect regulation to ramp up, particularly after the recent crypto-related meltdowns.

The Adventures of Tin200. The annual NZ Technology Investment Network (TIN) Report is out. The report benchmarks* the performance of what it categorises as NZ’s 200 largest globally-focused tech companies. It found:

Tech generated NZ$15.1bn in total revenue for FY22, up 9% (NZ$1.247bn) YoY. Accounting for 14% of total export revenue in FY22, tech is NZ’s second largest export earner behind dairy.

31 companies recorded revenue of more than NZ$100m – including four companies that topped NZ$1bn (F&P Healthcare, F&P Appliances, Datacom and Xero).

The number of jobs within TIN200 companies grew by nearly 11% (up 6,148) to 62,718 jobs, with the average employee’s salary being $89,711 (up $699).

*NZ investor Rowan Simpson questions TIN’s data collection and reporting.

$500m club. ELMO (HR & payroll) and Nitro (PDF tools) each received near-A$500m takeover offers from North American firms. The boards of both ASX-listed companies have recommended shareholders accept the offer. If successful ELMO will be acquired by K1 Investment, and Nitro by Alludo (owned by KKR). Esports hedge fund PAC Capital acquired Clearwater Portfolio Management, growing its funds under management to $500m.

This month’s fundraising trend: green tech

The Clean Energy Finance Corporation will administer a new $500m sub-fund on behalf of the federal government to commercialise and scale up technologies designed to cut emissions.

Samsara Eco, who have created a plastic-eating enzyme, raised $54m to build its first plastic recycling facility in Melbourne. It also took out two awards at the second annual InnovationAus Awards this month, including the Australian Hero and Energy & Renewables trophies.

Uluu raised $8m to make a plastic replacement from seaweed.

Nourish raised $45m to develop animal free fats and oils to bring flavour to plant-based foods.

SunDrive raised $21m to produce the world’s most efficient solar cells, which replace silver elements in solar cells with cheaper copper.

Greener raised $4m to help customers find greener brands, and offset the carbon for their purchases.

Kite Magnetics raised $1.85m to halve the size and weight of electric motors by 2030. The main use case for its tech is in aviation.

Amber Electric raised $13.5m to further develop its automation software that will allow customers to automatically charge solar battery and EV devices when electricity prices are low and sell power back into the grid when prices are high.

Climate Salad received LaunchVic funding to establish a team in Melbourne and run a Global Impact Incubator for Victorian-based climate startups.

Big Tech. Big Fraud. Big News.

Dumpsterfire. Almost 30k Australians are caught up in the collapse of FTX, once the world’s second largest crypto exchange valued at US$32bn. FTX plunged into bankruptcy “holding just $900m in easily sellable assets against $9bn of liabilities the day before it collapsed.” According to FTX’s lawyer, a “substantial amount of assets have either been stolen or are missing.” The fallout quickly rippled across crypto markets:

The price of Bitcoin dropped to its lowest level in two years - US$15,480. It is now sitting back above $16k.

Coinbase’s market cap dropped below US$10bn. This time last year, it was more than $70bn.

Cronos (the exchange token of Crypto.com) lost approximately $1 billion in value. Furthering the crypto mismanagement narrative, Crypto.com accidentally sent $400 million of Ethererum to another exchange.

Major crypto brokerage Genesis reportedly warned investors that it could go bankrupt without additional funding.

Speaking of fraud. Elizabeth Holmes, the Theranos founder and former CEO, was sentenced to 11.25 years in prison for defrauding investors in her failed blood-testing startup.

Because the real world isn’t enough drama. Apple is rumoured to start producing a mixed reality headset with a chunky US$1k price tag next year. Meta continues to pour billions into its VR and metaverse projects, despite cutting 11k jobs globally.

Bye Alexa. Amazon is gutting the team behind Alexa. The voice assistant is costing Amazon billions a year, and user and developer engagement beyond simple use cases (setting timers, asking the weather, playing music) has been limited.

End of an era-note. The once-great note-taking app Evernote has been sold to an Italian app developer.

Chief Twit. We won’t recap the entire chaos at Twitter. Instead, here’s our unsolicited take: Twitter needed a shake up. Elon has an incredible track record of ruthlessly getting teams to achieve commercial and engineering feats at a staggering pace. Do back him to turn the ship around? Yes. Do we agree with his management style and would we want to work for him? No. Are we worried about his conflict of interests? And the danger he poses having so much control and influence? Certainly.

For now, Twitter is a huge experiment. Can a slow incumbent turn back into a startup, and if so, at what cost? Is it possible to (very publicly) move fast and break things at scale, without completely breaking the beast or alienating your customers? Can you price new products by negotiating with a billionaire author??

Daily usage may be at an all time high, but only time will tell if Elon will succeed in the long term.

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

If you aren’t subscribed to the wrap, sign up now:

Watch Gav chat all things tech with Startup Daily at 2pm on Monday!

Seen any interesting startups? Have any tips for the Wrap? Want to indulge our inner-journalists? Drop us a note: tipoff@ignitionlane.com