Welcome to our Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world over the past month. Strap in… this is a big one!

If you love the Wrap, please spread the word and help it grow:

Forward this to friends/colleagues by email or Slack

Share on the socials with a short note

Life in the fast lane: Aussie tech news

Tiger’s growth funding implosion hits Aussie shores. This week The Information revealed NY-based Tiger Global’s $12.7bn ‘peak tech boom’ 2021 fund recorded a 20% loss as at the end of 2022. Tiger was the world’s busiest investor in 2021, fuelling extraordinary valuations and growth at all costs strategies… until the era of easy money came to a screeching halt.

In Australia, Tiger led Mr Yum’s record breaking $89m Series A (mobile food/drink ordering), TradeSquare’s $28m round (wholesale goods marketplace) and MilkRun’s $75m Series A (15 min grocery deliveries).

Now, a little over a year later, Mr Yum has made its second round of redundancies, MilkRun has collapsed making 400 people redundant, and TradeSquare has stopped trading in Australia as it shifts direction to “a new business model.”

The startup world flocked to the blogosphere to defend AirTree and other local investors for joining the Tiger bandwagon, and argue the case that startup failure is a healthy ecosystem feature.

Timing. Turns out the grocery behemoths agree with MilkRun that there is a market need for instant delivery. Just days after MilkRun shut down, Uber and Coles announced a partnership enabling customers to receive groceries from 500 stores within an hour. Each delivery will be packed and delivered by an Uber driver or delivery person. Woolworths also partners with Uber Eats for fast delivery.

What’s your moat? Instagram launched a new feature allowing users to add five links to their profiles, saying it was one of the most requested features by creators. TechCrunch:

in reality, it’s also an example of how Instagram’s failure to adapt to the needs of that community has allowed alternative solutions to thrive… The platforms would rather keep users trapped inside Instagram or their own network, rather than potentially lose users’ time and engagement.

The move muddies the future for “link in bio” companies, including Melbourne-based Linktree (which was last valued at US$1.3bn). Linktree’s CEO and founder Alex Zaccaria took to Twitter defending their value proposition.

Venture land. Blackbird took out top spot in The AFR BOSS Best Places to Work. Square Peg promoted James Tynan to partner. Flying Fox is raising $20m. Co Ventures launched its first $5m pre-seed fund, led by Maxine Minter. Alan and Carol Schwartz will commit $100m to green climate investments.

The latest Cut Through Venture figures show that only $661m was raised in the first three months of 2023, compared with $1.8bn in the final quarter of 2022.

Bumbling breaches. Personal loan and financial service provider Latitude suffered one of the biggest data breaches in Australian history, impacting around 14m customer records across Australia and NZ. Stolen data includes details for 7.9m drivers licenses and roughly 53k passport numbers. The attack originated at a third party vendor and involved stolen employee login credentials. Meanwhile, a class action has been launched for millions of Australians caught up in last year’s Optus breach.

Crypto corner. ASIC cancelled the derivatives licence for the world’s largest crypto exchange, Binance. Another crypto exchange, Independent Reserve, bought the Bitcoin.com.au brand for $3m. NAB completed a cross-border transaction using NAB-issued stablecoin - a world-first by a major financial institution on a layer-one public blockchain. Bitcoin is up over A$40k for the first time since June 2022 and a16z released the State of Crypto Report.

Mighty Melbourne. Big things for Melbourne tech: Catapult’s Racewatch software was used by seven out of 10 of the F1 Grand Prix teams and motorsport’s governing body, FIA, to analyse thousands of metrics in real-time. Envato made the cut again in the 4th edition of a16z’s Marketplace 100 (US grocery marketplace Instacart took #1 spot). Customer service firm Cyara acquired Irish communications testing company Spearline in a deal reportedly worth $150m.

LaunchVic has chosen nine scaleups for its mext cohort in the 30x30 program: JET Charge (EV charging), Preezie (eCommerce experience), Thriday (business financial management), Intelligence Bank (marketing operations and compliance), Halaxy (healthcare practice management), FourthRev (EdTech - digital careers), VendorPanel (procurement management), XY Sense (workplace sensors) and Great Wrap (Compostable Stretch Wrap).

Generative AI everything

DesAIgner. Canva booked 40 million new customers in the last six months and now has 3,500 employees, with plans to hire another thousand this year. Taking on Adobe, the design platform unveiled a suite of generative AI products ranging from text-to-image generation, a ‘magic’ editor, automatic branding kits, and automatic copywriting. The products stem from its acquisition of Kaleido.ai, an Austrian visual AI-start-up, in February 2021. Just like ChatGPT, Canva’s AI model has a bit more learning to do:

AI bankers. Bloomberg released a new AI model, BloombergGPT, designed to understand financial language and can process complex financial information, such as market trends, risk assessments, and portfolio optimisation. The tech could be used in a variety of financial applications, e.g. asset management or trading.

Text-to-video. Runway showcased its new generative video model, Gen-2, which it says will be available to users in the coming weeks.

AI Drake. “Heart on My Sleeve,” a synthetic song using Drake’s voice went viral. No-one knows who is behind the ‘Ghostwriter’ account that released the song, leading to all sorts of conspiracies:

Ghostwriter’s come-up is strange even for viral TikTok standards. “Heart on My Sleeve” could be a fluky viral hit, a sloppy stunt by a crypto-adjacent startup, a revenge prank by Drake himself, or the beginning of the legal battle over AI-generated work that is flooding the internet. Maybe a combination. Whatever it is, something weird is going on…

Existential risk. Elon Musk, Apple co-founder Steve Wozniak and other technology leaders have signed an open letter urging for a six-month pause to the development of AI systems more powerful than GPT-4 (OpenAI’s latest large language model). The authors say advanced AI represents a risk to society, with potential to spread misinformation, replace humans and remake civilisation.

Surprise, surprise - just a few days later, reports surfaced that Musk is working on his own rival to OpenAI, that he thinks he might call TruthGPT - a “maximum truth-seeking AI that tries to understand the nature of the universe” and that “hopefully does more good than harm.” Sure.

Opportunity in enterprise tech

The latest Battery Ventures Cloud Software Spending Report says the death of enterprise tech spending have been greatly exaggerated. In fact, 73% of survey respondents expect their enterprise tech budgets to stay flat or increase in 2023.

The report contains some handy tips for those of you in enterprise tech:

Renewals are the main driver of budget cuts, so you should aggressively nurture relationships well before renewal and focus on understanding and articulating customer health, product usage and value.

Adoption of new technologies is still happening, but expect slower sales cycles in today’s environment.

Evaluate cloud solution provider (CSP) marketplaces as a part of your GTM strategy. But this isn’t a “build it and they will come” solution.

Similar to point 3 - don’t wait for bottom-up and PLG sales motions to save you in this market. These should be part of, not all of, your sales strategy, given the conservative nature of buyers in today’s market.

The end of things around the world

Netflix DVDs. After 25 years and 5.2 billion DVDs, Netflix is ending its DVD-by-mail business. The service peaked in 2010, when around 20 million people subscribed to the service. Netflix also released its fourth quarter results: It added 1.75 million subscribers, bringing the total subscriber base to 232.5 million around the world; revenue was up 4% YoY to US$8.1bn - slightly less than analysts had forecast; and profit hit $1.3bn.

Alibaba conglomerate no more. Alibaba is doing a major restricting, splitting into six different business units, each with their own P&L and minority shareholders: cloud intelligence, global digital commerce, domestic e-commerce, local services (e.g., delivery), logistics and entertainment/media. Interestingly, the announcement came on the same day that Alibaba co-founder Jack Ma reappeared in China, after being away for more than a year.

Twitter. Elon Musk merged Twitter with X Corp, signalling move towards his vision of an ‘everything app’. Celebs are crying because Twitter has taken away free blue verification ticks. Oh and, Twitter is also no longer responding to journalist requests. Instead, the company’s press email is set to auto respond with the poo emoji.

Moore. Intel co-founder Gordon Moore has died at the age of 94. A pioneer of the semiconductor industry, he was known for formulating Moore’s Law in 1965, which predicted that the number of components on a chip would double every couple of years. Intel CEO, Pat Gelsinger:

He was instrumental in revealing the power of transistors, and inspired technologists and entrepreneurs across the decades. We at Intel remain inspired by Moore’s Law, and intend to pursue it until the periodic table is exhausted. Gordon’s vision lives on as our true north

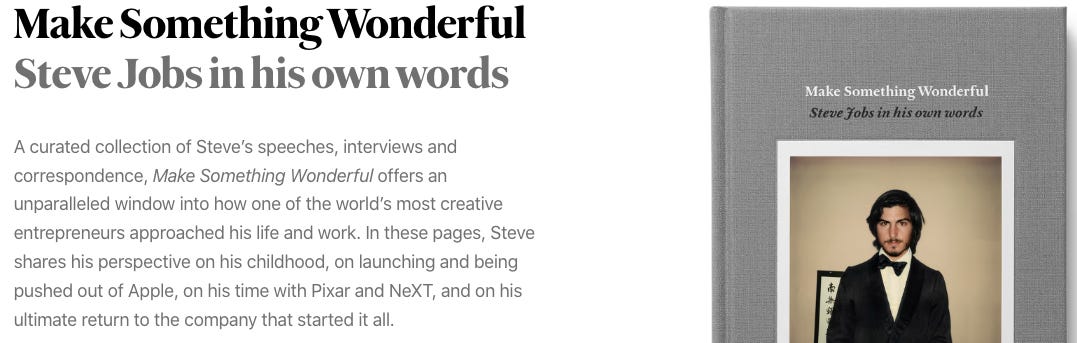

On that cheery note, we better end with some inspo. The Steve Jobs Archive released Make Something Wonderful, a curated collection of speeches, correspondence and photographs from Steve Jobs

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

If you aren’t subscribed to the wrap, sign up now:

Seen any interesting startups? Have any tips for the Wrap? Want to indulge our inner-journalists? Drop us a note: tipoff@ignitionlane.com