Weekly Wrap #28: Swamping Sales, Selling Startups and Seek is 23

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

Please keep the great feedback coming. If you love the Weekly Wrap, share away.

Thrift Shop

All cashed up and nowhere to go. What better to do than shop?! Well that’s what retailers are hoping for this month.

With Black Friday, Cyber Monday, Singles Day (an unofficial Chinese shopping holiday that celebrates being single) and Click Frenzy, November is a huge month in retail. This year Westfield is even chiming in with its own sale event - a Week of Offers at the end of November. Novel.

It’s fair to say online sale-days have come a long way since the #clickfail saga in 2012. The Australian-first Click Frenzy event set out to break all records, lining up big Australian and international retailers including Myer, Bing Lee, Microsoft, Toys R Us, Dell, Target and Priceline. But, alas, all that broke that fateful day was the Click Frenzy website… within just minutes of launching. Ooops.

Source: Facebook. The internet never forgets.

This week more than 800 Australian and global brands offered discounts during the 53-hour Click Frenzy. In the first 24 hours of the event, there were over a million shoppers on the platform. And that doesn’t include consumers shopping directly on retailers’ sites. Top performers included the usual online marketplace suspects (MyDeal, Catch, Kogan) plus bricks and mortar-focussed retailers including Myer, Platypus and The Good Guys.

Singles day—held on 11/11 with pre-sales running for 11 days prior—smashed all records in China. The shopping bonanza started in the 1990s (originally called Bachelors' Day by Alibaba's founder) and has grown to become the world's busiest day for online commerce.

Shoppers bought everything from apartments to luxury bags, appliances, daily necessities, and cars. Alibaba and JD.com reported that sales across their platforms totalled US$115 billion. Alibaba nearly doubled last year’s record.

Australian and NZ brands are getting a piece of the Singles day action too. Australia retained its place as the fourth most popular overseas products, following Japan, the U.S. and South Korea. At least 2,000 Australian businesses participated in the shopping event, netting over $1 billion in sales.

Source: Alibaba

As consumers, these sales events take advantage of our primal instincts. Limited time offers give us fear of missing out (fomo). In a form of Pavloian conditioning, the word ‘sale’ alone drives us to spend money.

For most retailers, participating and offering discounts on these days is no longer optional. Even more so now that the world has become accustomed to online shopping.

Data released last week by NAB showed that online retail in September grew 62.7% YoY. Australians are estimated to have spent $40.9 billion on online retail in the 12 months to September. That’s about 12% of total retail spend and 39% more compared to the year before.

We’re seeing this flow through into public company results, too. Wesfarmers' (Bunnings, Kmart, OfficeWorks) online sales, but excluding Catch Group, increased 166% for the year to 31 October 2020. Even if you exclude Melbourne from those figures, online sales rose 98%. Catch Group’s sales (gross transaction value) are up 114.4%.

We should expect all new records for November. Particularly with Australian consumer confidence at a seven year high. *Stunned face*

The real question is to what extent will we return to bricks and mortar as a primary shopping destination?

Regardless, retailers need to take action so their businesses thrive in this new world order. Now more than ever, that means orienting towards customers’ wants and needs, and nailing customer experience.

Know when to fold em

Subscription analytics and insights startup, Baremetrics sold to a private equity firm for $4 million. Now, that’s not particularly ground breaking in terms of valuation or startup news. However Baremetrics’ founder and CEO, Josh Pigford wrote this transparent piece on the acquisition, and we decided it was worthy of its own Weekly Wrap section.

Pigford founded Baremetrics seven years ago. It received $800k in seed funding from General Catalyst and Bessemer, but is otherwise bootstrapped. As we mentioned above, he sold the business for $4 million in cash and walks away with $3.7 million, thanks to the VCs writing down their investment (unusual, we know).

The acquisition is a great illustration of a buyer and seller working together to structure a deal that works for both parties:

Not all valuations are created equal: Baremetrics sold at a multiple of ~2.65x ARR - pretty low in the context of a ‘successful’ sale. But, in return, Pigford received cold hard cash, paid in three instalments (close, 12 and 18 months). Most importantly for Pigford, there’s no earn out and it’s enough to provide financial security for his family.

Understanding what you’re good at: Pigford realised he loves being a “maker”, not a “manager”. Running a seven-year-old startup generally means a lot of managing, less making. This also relates to the point above - sticking around for an earn out was not appealing for the same reason. For other founders in this position, often a good alternative is to appoint a CEO rather than selling.

Do right by the team: Everyone had the option of keeping their job. Anyone who had stock options received the full value of their options. Those that didn’t receive a bonus.

Before you dive into a deal, take the time to figure out your own and the other party’s drivers. It’ll save you in the long run.

Rapid fire: News that caught our eye this week 🧐

Australia & NZ

HiPages listed on the ASX on Thursday, raising AU$100 million in its IPO and valuing the business at $318 million. Shares initially jumped nearly 16% in opening trade before settling back down around the IPO price. David Vitek and Roby Sharon-Zipser co-founded Hipages in 2004, raising around $50 million from various venture capital firms along the way. With 1.4 million jobs posted to the platform in FY20, Hipages is now the country’s leading online platform connecting consumers and tradies in Australia. Congrats!

Inventory management software business Unleashed will be sold to UK-based The Access Group. Unleashed’s CEO, Gareth Berry explained:

Joining Access gives Unleashed a new level of expertise in the provision of integrated software solutions, an acceleration of our product development and gives our customers the opportunity to explore a wider range of ERP and business management solutions from a single provider.

Unleashed was founded in NZ over 10 years ago by Greg Murphy. Since then Unleashed has grown to service more than 4,000 customers across the UK, EMEA, US, New Zealand and Australia. Amazing work Gareth, Lisa and team!

Language translation tech company Straker Translations scored a huge deal with IBM causing its shares to leap more than 50% in one day. The deal significantly expands on Straker’s current relationship with IBM, up from providing one translation service language (Spanish) to 55 languages.

NAB is partnering with Lighter Capital, which provides revenue-based financing to early stage companies. Great to see more financing options opening up for founders in Australia.

It’s NAIDOC week. NAIDOC Week celebrations are held across Australia each year to celebrate the history, culture and achievements of Aboriginal and Torres Strait Islander peoples. Our favourite finds:

To help us document and learn words from Australian Indigenous languages, University of Melbourne have created an online resource – the 50 Words Project.

Mentoring software startup Mentorloop is partnering with Indigitek to bring their 2021 mentoring Program to life, joining them in their mission of increasing tech pathways for Aboriginal & Torres Strait Islanders in Australia.

Jobs marketplace, Work180 interviewed First Nations Peoples working for Endorsed Employers across Australia. As well as sharing experiences, their rich responses make for must-read guidance on what more organisations could and should be doing to attract, retain, and nurture Indigenous employees.

Supply Nation compiled a database of verified Indigenous businesses - great for organisations wanting to create a more diverse supply chain or to find festive season gifts.

Startup Daily featured nine First Nations startup founders changing Australian entrepreneurship.

Sunman Energy closed a US$12 million Series B led by the Clean Energy Innovation Fund and Southern Cross Venture Partners. Sunman develops eArc solar panels, which made from a lightweight polymer composite material. eArc panels are flexible, thinner and 70% lighter than a glass panel. This makes them cheaper to transport and easier to install because they can be glued to a surface.

Renowned physicist Cathy Foley has been appointed as Australia’s next Chief Scientist. Foley is a multi-award winning physicist. She has worked at CSIRO for 36 years and her work in superconducting materials has revolutionised the way mineral deposits are located.

It’s Seek’s 23rd birthday! Check. out. those. ties.

KPMG Australia’s High Growth Ventures is conducting annual research into the physical and mental wellbeing of startup founders. The 2019 report surveyed 167 founders and 35 VC firm representatives and found that, while 40% of founders were satisfied with the progress of their startup, only 22% were satisfied with their stress and mental wellness. Just 20% had seen a counsellor or therapist in the past year, and 70% had spent zero on mental health. Founders - please fill out the 2020 survey here (closes on 30 November).

Around the world (all in USD)

A good day for gene-based vaccines; a bad one for Zoom shares. Pfizer and BioNTech announced that their gene-based vaccine was 90% effective at preventing symptomatic COVID-19 in clinical trials. The announcement sent Zoom and other pandemic-darling stocks plunging (although most are climbing back up again) and saw airline stocks climb. Gene-based vaccines have long been touted as the future of vaccine development. However, until now, they’ve been largely experimental. If approved, this will be the FDA’s first gene-based vaccine allowed to be used in humans. There’s still a long way to go, though.

Virtual events software provider Hopin closed a $125 Million Series B led by IVP and Tiger Global. To say Hopin has benefitted massively from the pandemic is an understatement. This raise (its third round this year) values the 17-month-old company at a staggering $2.1 billion. Eight months ago Hopin had eight employees, 5,000 registered users, and 1,800 client organisations. Today it has 200 employees, 3.5 million users, and 50,000 organisations. According to founder and CEO Johnny Boufarhat:

Events will never go back to the way they were — hybrid is the future, and our investment in innovation and in our products will be toward moving the world to hybrid events.

Disney+ turned one and has more than 73 million paid subscribers - “far surpassing our expectations in just its first year”. Hulu had 36.6 million, while ESPN had 10.3 million subscribers (more than doubling from 3.5 million a year earlier). According to CEO Bob Chapek, “The real bright spot has been our direct-to-consumer business, which is key to the future of our company”.

Apple unveiled its new M1 chip, which will power its new generation of Arm-based Macs. And it is fast. Real fast. It will offer the “longest battery life ever in a Mac”, delivering the same peak performance as a typical laptop CPU at a quarter of the power draw. The new MacBook Air can power up to 15 hours of wireless web browsing (vs 11 hours on the old version) and up to 18 hours of video (vs 12 hours) on a single charge. It also doesn’t require a fan, so “no matter what users are doing, it remains completely silent”. However some argued that the new Mac designs are safe and underwhelming. If you want to nerd-out more- here’s a great thread on 35 years of processor development.

Amazon’s in trouble with European regulators. The EC has reached a preliminary view that Amazon is illegally using its dominant market position to the detriment of other marketplace sellers. It aggregates data from sales made across the platform to calibrate its own retail offers and strategic business decisions (e.g. to focus its offers in the best-selling products across product categories). The Commission will open a second antitrust investigation to look at whether Amazon gives preferential treatment to its own retail offers and marketplace sellers who use its logistics and delivery services. Specifically, how Amazon decides which merchant to link to using its ‘Buy Box’. Amazon could be fined as much as 10 percent of its annual global revenue.

Another Spofity podcast acquisition. Spotify is acquiring podcast hosting company Megaphone for $235 million, which will allow more shows to use Spotify’s proprietary real-time ad insertion technology. This is all part of its strategy to gradually entice/force people to use its services. As we explained in May, “The ultimate prize for [Spotify] is ad revenue. Own the audience, control billions of dollars of ad spend.” Podcast monopoly money. Tick.

Estonia-founded sales CRM, Pipedrive became a unicorn after PE firm Vista Equity Partners acquired a majority stake. Founder Timo Rein on why Pipedrive is successful in spite of big competitors like Salesforce:

When we entered the market in 2010, people asked us, ‘Why build a product in an area where Salesforce is already strong?’ But having been in sales for more than a decade ourselves, we realized that it’s not just the sheer number of features you offer users. The difference is finding the right spot on the spectrum where you are getting what you need out of a product that you can use.

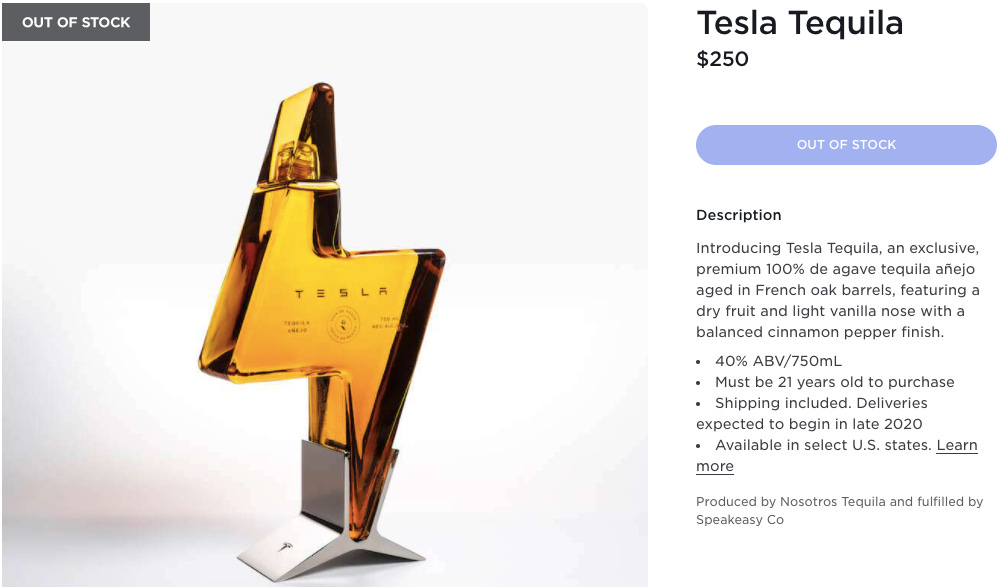

Tesla upped its merch game with $250 Tequila. Bad news - it’s all gone. This actually isn't Tesla's first foray into odd merch. In a nod to the investors that "shorted" the company's stock, Musk's team started selling satin red gym "short shorts" for $69.420 each in July.

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

p.s. Don’t miss our upcoming Blackbird Giants webinar session - ‘Sales as a Science’. Our very own sales master Nikki Brown will be sharing her secrets on how to get a sales machine humming. Tues 24 November, 8am. Register for free here. Sales as a Science - it's the new SaaS!

We love feedback - if you have any or want to continue the conversation, please reach out.

Watch Gavin live on AusBiz at 2pm on Mondays, when he opens the Startup Hour of Power.