Weekly Wrap #21: Embracing the online revolution, podcast movies and in-home drones

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

Please keep the great feedback coming. If you love the Weekly Wrap, share away.

You’d never have guessed (you would)

AusPost released its ‘Inside Australian Online Shopping’ update this week. The growth is, not surprisingly, bananas or in the words of AusPost (echoing Benedict Evans), “like five years growth in three months”.

August 2020 smashed all records:

August saw almost 10% more online shopping purchases than the busiest season last year - the pre-Christmas rush.

In Victoria, online sales increased 170% YoY.

Between March and August 2020, more than 8.1 million households shopped online, up 16% YoY. Nearly 900,000 new households shopped online for the first time.

There were 200,000 new online shopping households in April 2020 alone and bout 67% of those continue to shop online.

And we haven’t even hit Black Friday/Cyber Monday or Click Frenzy yet.

These trends are echoed all around the world. In the US ecommerce sales rose 32% in Q2. The UK went from 22% ecommerce penetration to over 32% from March to May.

According to one study, 49% of consumers globally say they’re shopping online more than before. This figure rises to 70% for Mexican, 62% for American, 59% for Canadian and 58% for UK shoppers.

Source: Benedict Evans

Embracing online

One reason people resist change is because they focus on what they have to give up, instead of what they have to gain - Rick Godwin.

Without a doubt, assumptions about how consumers buy, and how brands and retailers sell, have been reset by the pandemic. It has forced people on both sides of the sales equation (i.e. buyers and sellers) to get comfortable with online shopping, fast.

The billionaire founder of Harvey Norman, Gerry Harvey is one such person. Having always refuted the ecommerce business model, Harvey has for a long time been dismissive of the threat posed by young upstarts like Kogan.com. From 2010 until as recent as 2018, Harvey has described online retail as a “dead end” and “over hyped”:

Fortunately, Harvey Norman has been investing in its online offering since 2011, despite Harvey’s disdain for the model.

Fast forward to 2020 and Harvey is revelling in record results thanks to lockdowns. Now, profits are up 185%, with growth rates that Harvey says has “never [before] happened in my lifetime”. While Harvey Norman has not disclosed its online vs physical sales figures, it would be hard to imagine that online sales haven’t had an impact on its recent results.

And yet, Harvey is still reluctant to embrace the online opportunity, although he’s sure changed his tune:

I've only got one way to go, and that's wherever the market takes me. But if you give me a preference if I'd rather have 10 per cent or 30 per cent [online sales], I'd rather have 10 because I won't make as much money.

Its online pureplay competitors Catch Group, Kogan, Brosa and Amazon would certainly disagree. Kogan’s cost of doing business is estimated to be just 6%, while Harvey Norman’s is more than 40%.

Source: AirTree

Even the likes of Ikea—with a core strategy centralised around the physical store experience, bulky (expensive to ship) products and a big store footprint—sees the writing on the wall:

Now the shops are reopening, the level of eCommerce has actually sustained so it seems as though there is a permanent shift towards online and its convenience.

As does Coles, whose online sales were up 60% in the first six weeks of the new financial year. In fact, Coles’ investment in digital provides an example of how traditional but forward-thinking businesses are adapting for growth in our future world. Coles is increasing its digital initiatives budget 50% a year for the next five years - an estimated $200 million investment.

Coles is now embracing change on multiple fronts:

Using data and technology to its advantage. From supply chain to inventory management to order fulfilment and loyalty programs, Coles is investing in making the most of data and technology to create efficiencies and better serve its customers. To do this, it is partnering with leading technology providers like Ocado, Microsoft, SAP, Adobe and automated logistics provider Witron. Its ‘Smarter Selling’ strategy, which is centred around using data and technology to optimise the business, has already achieved $250 million in savings. And they’ve only scratched the surface.

Elevating the online customer experience. Coles almost doubled its online capacity in 2020, making the most of its physical footprint with a rapid rollout of contactless Click & Collect. Recently, Coles has re-engineered its main website, coles.com.au to create a better online experience (including a digital portal that offers daily refreshed deals and content: Coles&co), as well as its Liquorland, Vintage Cellars, First Choice Liquor websites. These sites would likely include a personalisation strategy to increase conversion and retention rates. Coles also partnered with loyalty program Flybuys to create a way for customers to easily pay online using Flybuys points.

People as an investment, too. In May, Coles added Ben Hassing to lead ecommerce. Hassing previously ran Walmart's ecommerce business in China. And because there’s nothing like a financial incentive to align people and shift behaviours, this week Coles announced it is changing leadership KPIs to include an online sales metric - in a “shift [that] demonstrates the importance of growth in the online channel to achieving our strategic goals”.

Coles realises that a long-term adaptive strategy requires more than just creating an online offering, click-and-collect or solving the delivery dilemma. Embracing online and preparing for inevitable change is about finding new and better ways to stand out and deliver value to customers.

Throwback to one of Harvey Norman’s original ads - a bit of entrepreneurial spirit to disrupt the status quo.

Rapid fire: News that caught our eye this week 🧐

Australia and NZ:

Since we’re on the topic of consumers, our friends the PR gurus at Character + Distinction last week held a series of webinars with journalist, brand and product experts. Lucky for you they’ve agreed we can share the key takeaways here. It is full of insights and practical tips around building habit-forming products, engaging journalists, creating a brand in Covid, winning the hearts of consumers, etc etc.

Movac has a new NZ$200 million fund to invest in kiwi startups. It is the biggest NZ VC fund to date and the first to get significant KiwiSaver (Super) fund backing. Raising VC money in NZ has historically been very tough. It was only a few years ago that Lance Wiggs, Chris Humphreys and the team at Punakaiki struggled to raise just a few million for its first VC fund in 2013. Like all great entrepreneurs they hustled and remained determined to continue on their early-stage VC mission. Off the back of numerous sub-$5 million raises, Punakaiki Fund now has $60 million assets under management and has funded several awesome NZ startups from their earliest of days, including Mobi2Go, Timely, Conqa, Onceit and Boardingware. So, the new big Movac fund is hopefully a sign of terrific things to come in the NZ VC space.

Up bank shared its app design secrets and evolution, including how it has game-ified banking (in a non-gambling way). Great read. Great product.

Startmate kicked off its Fellowship program this week, with 100 women in this cohort. We’ve spied the bios of a few of women taking part and can’t wait to see what lies ahead for this impressive bunch.

Have you, like Gav, ever had a wasp’s nest or rodent infestation at your house that you needed cleared immediately? Fear not, there’s an app for that. hipages lists over 100,000 jobs just like this each month, making it an interesting prospect for fundies as they head for IPO. (Not an ad.)

Not strictly tech-related but… Friday was (unofficially) Cathy Freeman day. For those of you in Australia, the FREEMAN documentary is available on ABC iView.

Around the world (all in USD):

Tesla’s vertical integration strategy just got bigger and better. This week Elon Musk made some big announcements at Tesla’s ‘Battery Day’ event: it plans to eliminate cobalt in its batteries (cobalt is notorious for being mined under conditions that violate human rights), showcased a “tabless” battery that could significantly improve range and power, and is investing in a new cathode plant to make battery production more efficient. In five years Telsa intends to be able to produce a $25,000 car, significantly expanding its addressable market. All of this leaves us wondering whether the traditional auto industry will ever be able to compete.

Amazon unveiled new Echo and Ring devices on Thursday. There’s a lot of talk in the media at the moment about big tech and privacy, but we’re yet to see proof that this is actually affecting the average Joe’s tech consumption and purchase decisions. These two updated Amazon products could give the privacy-conscious amongst us heart palpitations - the Echo Show 10 enables people to set the device to follow them around the room to keep them in view. It can also be used as a remote camera to “check in on the dog while you’re running errands”. The “Ring Always Home Cam” is a home security drone. Crazy.

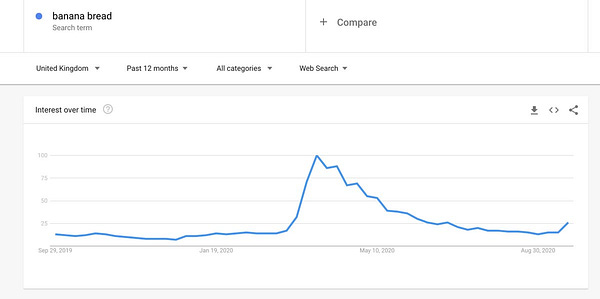

Just as you can see the traffic status on Google Maps, Google is introducing a Covid layer that reveals hotspot information. Sadly it appears the UK might be making good use of that function soon, particularly if Google search data for banana bread is anything to go by:

WeWork continues to struggle to turn itself into a viable business. This week it has sold control of its China business to an investment firm in a $200 million deal.

Epic Games, Spotify and others have joined together in a ‘Coalition for App Fairness’ to fight Apple and Google’s monopolistic behaviours over their app stores. The first principle of the App Store Coalition fight club is that “no developer should be required to use an app store exclusively.”

Spotify is continuing to execute its podcast strategy. This week it signed a deal with Peter Chernin’s entertainment company (producers of Ford v Ferrari, The Greatest Showman, Hidden Figures, New Girl) to adapt Spotify’s catalogue of exclusive podcasts into films or series.

The EU is considering new laws that would require Apple to give third parties access to its devices’ NFC technology, which would open up access to its payment technology. Apple is already subject to a similar law in Germany. In Australia, Apple managed to win a 2016/17 ACCC battle against several major Australian banks (CBA, Westpac, NAB, and Bendigo and Adelaide Bank) who wanted to band together to boycott the Apple Pay platform and bargain with Apple to open up the NFC in its devices. If the EU enacts this new law it is possible other jurisdictions will follow suit, particularly in light of the latest big tech anti-competition concerns.

Another day, another celebrity startup investment. After successful investments in mattress retailer Casper and alt-meat company Beyond Meat (both now public), this week Leonardo DiCaprio took his tech investing to a new level by becoming a major LP in Struck Capital - a seed fund focused on LA-based startups. Also this week, the home fitness craze has been winning the attention of famous athletes with Stephen Curry and Serena Williams backing a $110 million raise by AI home gym, Tonal.

Microsoft is planning to acquire ZeniMax Media Inc., who owns the storied video-game publisher Bethesda Softworks, for $7.5 billion in cold hard cash. This will be the second biggest game purchase ever and will give Xbox ownership of lots of popular games (Fallout, The Elder Scrolls, Doom, Wolfenstein, Dishonored).

Happy 13th birthday Airbnb!

That’s a wrap! We hope you enjoyed it.

Gavin, Bex and the team at Ignition Lane

p.s. We love feedback - if you have any or want to continue the conversation, please reach out.

p.p.s. Watch Gavin live on AusBiz at 2pm on Mondays, when he opens the Startup Hour of Power.