Weekly Wrap #9: Shocks, Stocks & Shops

Welcome to our Weekly Wrap, where we cut through the noise to bring you our favourite insights from the technology and startup world.

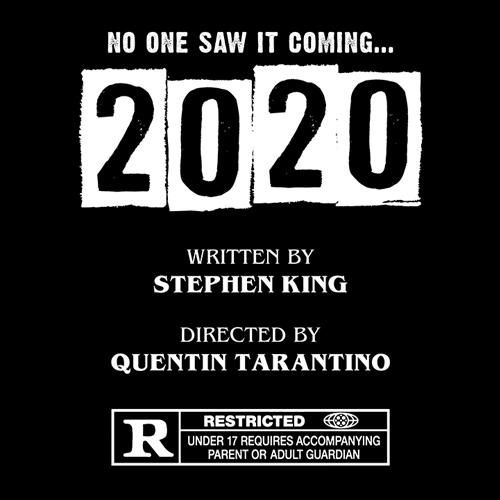

What. A. Year.

Oh, wait! We’re only half way through.

This week we took some time to reflect on the half-year that was, including some mammoth changes and trends in the tech world.

A host of industries and their workers were upended without much warning - events, hospitality, travel, recruitment and consulting to name a few. Months later, we still haven’t seen the end of redundancies. Some people were able to move jobs into to high demand areas like eCommerce. However we’re still doing little to address the ever increasing divide between our skillsets and future job requirements.

The world has been flipped upside down, but that hasn’t stopped public and private stock prices climbing high, resulting in some newly minted multi-billionaires.

We’ve changed the way we buy. Physical retail has been hit hard, while eCommerce booms.

Source: Ben Evans

We’ve changed the way we work. Cloud and digital transformation has exploded as a result. We’re using the first generation of a lot of these product categories (e.g. Zoom, Trello, G-suite), but there are a new generation of products on the rise (e.g. Notion, Superhuman) and in the making - and that’s exciting.

We’re seeing a power shift in entertainment and media - new platforms like TikTok becoming mainstream (and banned by governments), new content kingmakers in streaming and podcasts, brands boycotting Facebook and a decrease in overall ad spend.

For some, our sense of community has been bolstered as we rally behind movements like Black Lives Matter, whose messages have been elevated through our increased attention on social media. In tech, this has also led to a review of facial recognition AI, with IBM, Microsoft and Amazon stopping U.S. Police Departments from using its facial recognition technology for racial profiling and mass surveillance. Meanwhile, others use social media to unite closer around nationalistic ideologies.

For those of us in the tech world, none of these trends are particularly new or surprising. However, the acceleration by which change is happening is unprecedented.

This week we take a quick look at a couple of these trends. Enjoy!

Panic buying: Have retail investors lost the plot?

But a pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors learns some very old lessons: First, many in Wall Street - a community in which quality control is not prized - will sell investors anything they will buy. Second, speculation is most dangerous when it looks easiest.

Warren Buffett, Letter to Berkshire Hathaway Shareholders, 2000

Afterpay’s co-founder Nick Molnar hit headlines this week after he became Australia’s youngest self-made billionaire when Afterpay’s market cap hit AU$18B. For context, that’s over 11x Kogan’s market cap, double Canva’s latest valuation and 2.5x Qantas’ market cap.

Afterpay’s shares shot from a low of $8.01 in March 2020 to a high of nearly $70 this week. As Niki Scevak (Co-founder & Partner at Blackbird Ventures) pointed out:

How is that even possible, you ask?? This SMH article explains the recent rise and concludes:

[A severe recession and resulting bad debts] are risks largely ignored by investors that have been pushing up the share price - many of them small mum and dad sharemarket dabblers.

And share price momentum is a powerful force, as is being ascribed disrupter status.

Similarly, professional traders in the U.S. have blamed apps like Robinhood and social media bloggers like David Portnoy (quoted below comparing himself to Warren Buffett) for encouraging young people to recklessly trade risky stocks like Hertz (a bankrupt company whose share price rose 1400% in days), causing the market to rally in the process.

I’m not saying I had a better career… He’s one of the best ever to do it… I’m the new breed. I’m the new generation. There’s nobody who can argue that Warren Buffett is better at the stock market than I am right now. I’m better than he is. That’s a fact.

Robinhood is a millennial-focused commission-free trading app that has seen a surge in new users and trades during the pandemic, with 3 million people joining in Q1 2020 as stocks plunged.

However, a recent analysis by Barclays found that Robinhood traders’ top picks are underperforming - “[there is] a negative correlation between a change in the number of Robinhood customers holding a stock and the return of that stock.”

So if millennials aren’t driving up prices, and institutional investors say they aren’t buying, who does that leave… boomers and the bots?! 🤖

eCommerce is going bonkers. Is this just the start?

There’s much uncertainty about global markets, Covid-19 vaccines, trade wars and job security right now. But what’s clear is that Covid-19 has broken our buying habits and, although we may be spending less overall, that isn’t impacting every retailer equally.

Brands with a quality online experience are winning big. According to Inside FMCG, Australians are now spending almost AU$32 billion online (10 percent of all shopping).

Here in Australia, established online pureplays like Kogan.com, Catch, Temple and Webster, Adore Beauty are all hitting record high revenues. Now they’re preparing to capitalise on their online advantage - acquiring distressed companies and investing in tech to fuel efficiencies at scale.

Brand acquisitions - if the start of this year is anything to go by, we’ll sadly see plenty of distressed retail brands up for grabs.

Of all these players, Kogan.com is the most experienced at acquiring distressed brands and bringing them into its fold. In 2016, Kogan acquired Dick Smith online and it did the same with Matt Blatt in May. Kogan is now raising AU$115M (fully underwritten) to fund further acquisition opportunities.

Temple and Webster, whose sales for the five months to the end of May were up 90 per cent to more than AU$77 million, is also in the process of raising AU$40M.

Tech-enabled efficiencies - we’ve recently seen some big investments into fulfilment centres.

Both Temple and Webster and Kogan.com use eStore Logistics, who recently announced an AU$40M investment into two robotic-powered centres.

Amazon, who entered the Australian market around 3 years ago with lots of kerfuffle but little impact, has also announced an AU$500M investment into a Sydney-based fulfilment centre.

So the question isn’t whether these businesses will survive through the pandemic. Rather, it’s who is going to execute the biggest land grab?

If you’re in the consumer space, what are you doing to make the most of the opportunity ahead?

Work: Time for a refresh

We’ve already written a lot about the shift to remote work, video conferencing tools, and emerging productivity tools. But more than just adopting new tools, the last three months have thrown into question fundamental assumptions around office-based work.

In particular, these fallacies have been challenged:

Your people won’t be productive if they’re out of your sight. We’ve heard comparatively progressive people managers raise concerns about productivity while teams work remotely, asking what productivity metrics they should track. If you’re asking this, you’ve already set yourself up for failure.

Everything needs a meeting. Everyone knows most meetings are crazily unproductive. But change is hard unless you’re forced. So only recently have people started to adapt the way we work to fit the asynchronous tools that are, quite literally, at our fingertips:

Collaborative document editing results in far more efficient, thoughtful input compared to say… holding meetings to plan for future decision making meetings.

Channel-based, cross-organisational tools with great search functionality, like Slack can dramatically reduce email.

Permanent communication (ie writing and video) generally makes much more sense than one-off oral communication. Take Town Halls for instance. They’re a huge waste of time (and therefore money) if the messaging isn’t well thought through or delivered concisely to everyone at the same time. Our friends at AllHands are running a private beta for an awesome new tool that fixes this exact problem - reach out to us if you want a free account.

Every person should work Mon-Fri, 9am-5pm. Many of the businesses we work with have recently cut back to 3 or 4 days a week to preserve cash. Yet they’re all almost as productive as full time levels. There’s data to back the 4 day workweek business case too - pre-pandemic Microsoft Japan says it caused productivity to rise by 40% and electricity costs to fall by 23%. We need to shift the conversation from the ‘hours we put in’ to the ‘outcomes we achieve’.

Work-life balance. Our work and home lives are now so integrated that it is impossible to think of them as separate. Work-life integration is much more reflective of our the competing demands in our lives, whether that be young children, maintaining our wellbeing or looking after sick or ageing relatives.

We love that biscuit-bribe scenes like these are becoming normalised:

Here’s another, just because. If you’re running an online event or customer meeting and a kid interrupts, take note of the way this anchor engages with her daughter (stark contrast to the robot-like anchor in the one above).

The hardest element of remote work is how you create the social side of the office. We’ve found that:

Virtual coffee breaks are great, but keep them short and don’t schedule them everyday.

Not everything needs to be remote, you can still schedule walking meetings or coffees.

Virtual quiz nights are a fun way of bringing people together. Here’s one of our recent quizzes (get in touch if you’d like the answers).

Encourage virtual team lunch attendance by giving everyone some food credit. This is also a great way of getting prospects onto your webinars too.

The working world was designed for an era very different to the world we live in today. Challenging some of our closely held beliefs can result in a better worklife with happier, more engaged, more productive people.

That’s a wrap! We hope you enjoyed it.

Watch Gavin live on AusBiz at 2pm on Mondays, when he opens the Startup Hour of Power.

The team at Ignition Lane

p.s. we love feedback - if you have any, please let us know.

p.p.s. please share with your friends and reach out if you want to continue the conversation of any themes in this week’s wrap.